Debtors

Debtors

What are Debtors?

The term debtor originates from the Latin word ‘debate’, which means no one.

A debtor is a phrase used in accounting to describe an entity or person who owes money to another person, organisation, or business. A debtor may be an individual, a corporation, or another legal person who owes money to someone else – such as your company. You are a creditor if you have one or more debtors.

To put it another way, the debtor-creditor relationship is an extension of the customer-supplier relationship.

Debtors are recorded as assets in the balance sheet under the section current assets, and these are also known as accounts receivables.

Example of debtors

● Trade debtors are people who owe money to other people.

● Loans to staff

In general, a debtor is a customer who has bought a product or service and owes a bill to their supplier. It means, almost all businesses and individuals are or will be debtors at some point because everybody makes transactions as a consumer in some way.

How does an individual become a debtor?

A ‘debtor’ can be an individuals, corporations, banks, loan firms, government, among other things. Debtor is a person or entity who owes money to another person or an entity for goods sold or services rendered.

What options do you have for dealing with debtors?

If a debtor fails to make a payment by the due date and/or the normal payment window, a creditor (either a person or a business) may take various steps to recover the money owed.

There is a widely agreed escalation of conduct, starting with a polite reminder and progressing to filing a lawsuit in the claims court if the problem persists.

For instance, ABC ltd sells iphones and tablets of £200,000 to XYZ on 60 days credit. ABC ltd is a debtor till it repays XYZ ltd the full £200,000.

Debtors and repayments

Debtors are presented in the financial statements based on the duration of their debt repayments. Short-term debtors, for example, are those whose unpaid debt is due within a year.

Long-term debtors, on the other hand, owe sums that are due for more than a year. Under the company’s long-term assets, the sums are reported as long-term receivables under non current assets.

The credit terms beyond a year are uncommon. Normal credit terms are between 15 days to 2 months.

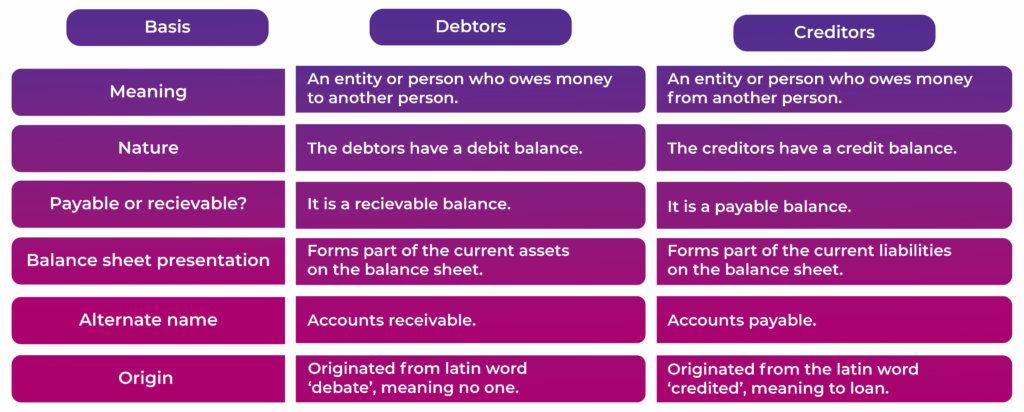

Debtor vs. Creditor