Hiring a Chief Financial Officer (CFO) can be a valuable asset in a startup. These financial experts can assist a business in improving its financial health with their insights and guidance. However, outsourcing CFO tasks can minimise the costs of hiring and yet have experts backing your startup.

This blog post talks about the best outsourced CFO services your startup requires and how to choose such service providers.

Table of contents

- What are outsourced CFO services?

- Why should I outsource CFO services for startups?

- Top 10 outsourced CFO services for startups

- Evaluating the outsourced CFO services cost

- FAQs

- Final thoughts!

What are outsourced CFO services?

As the name implies, outsourced CFO services, or fractional CFO, refers to outsourcing the tasks typically performed by an in-house CFO to a third-party company or individual on a contractual basis. It means they aren’t your full-time employees, saving you on employer NIC, pension and other perks typically given to full-time employees.

A Chief Financial Officer is a top-level financial expert who can help predict your startup’s performance over the next few months and years. It includes projecting expenses and revenues, looking for growth opportunities and potential risks and ensuring strategic business success.

However, hiring such professionals in-house can be a financial concern for startups. Therefore, you can outsource to virtual CFO services that offer the same expertise and knowledge but cost you less.

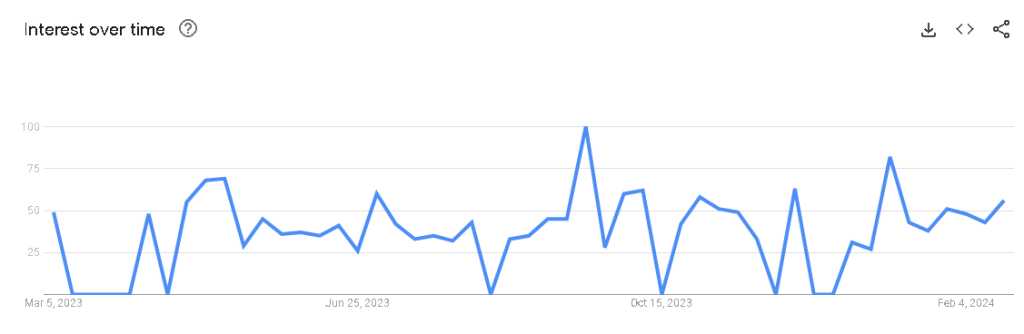

The graph below illustrates the demand for CFOs in the UK during the past 12 months.

Why should I outsource CFO services for startups?

You should outsource CFO services for startups to minimise costs and gain access to professional expertise. They assist in financial planning, budgeting, and forecasting, which is essential for creating accurate financial reports. These reports can be produced while raising funds for your startup or applying for a loan.

Such professionals can identify your key performance indicators and provide valuable insights for decision-making. Thus, you can get controller-level services without hiring a full-time CFO.

The table below illustrates the pros and cons of outsourcing CFO services for startups.

| Pros | Cons |

| Reduced cost of hiring | Less connection to the business |

| Access to objective perspective and fresh insights | Lack of understanding of industry-specific opportunities and challenges |

| Gain expert financial guidance | Limited communication |

| Reduced risk of fraud | Potential for unexpected costs |

Top 10 outsourced CFO services for startups

Here are the top 10 outsourced CFO services that are essential for startups.

1. Financial reporting

Financial reports are the balance sheets or profit, loss, and cash flow statements showing your startup’s financial health. The CFO is responsible for reviewing these statements and ensuring they accurately represent your current financial position.

These statements are a great help when you’re looking for investors.

2. Financial projections

Every startup needs financial projections to determine its revenue potential in the future and convince investors to fund it. These projections form the base of your budget planning and business investment.

An outsourced CFO service knows multiple industries and business sectors. They can carefully study your historical and present data to estimate growth in the coming years.

3. Scenario modeling

CFOs help in developing scenario modelling that creates alternative projections for your startup. This shows how you are likely to perform in different situations. It ensures your startup operates smoothly and maintains financial health during the worst conditions, like economic shocks, rising interest rate environment, etc.

Your startup can adapt to unique circumstances without compromising business continuity.

4. Planning budget

Budget planning is essential for all startups that set the target on how you should perform every month to achieve your projections. The outsourced CFO services will compare your actual financial data with the budget and report on whether your business is on track or underperforming.

They may also guide you in creating better budgets and ensuring your finances are under control.

5. Cash flow management

One of the biggest problems that startups face is cash flow management. Hiring an outsourced CFO can help you understand cash inflows and outflows, essential when your funds mostly go towards product launches. During this phase, startups usually run out of funds, leading to difficulty in running the business smoothly. But CFOs have the best solution for your cash flow management and provide valuable insights to meet your changing business demands.

6. Data analysis

Any business needs to make data-driven decisions. The CFO analyses your finances and business activities, including sales, inventories, payroll, and customer behaviour. By properly analysing and interpreting your financial data, they identify areas that require close monitoring and help businesses make strategies that work in their favour.

7. Building financial strategy

Startup owners find it difficult to understand various business scenarios and make decisions that go against their favour. By hiring an experienced CFO, you can get the right advice on your financial and business viewpoints.

They formulate and implement plans related to business models, product pricing, company expansion and acquisitions, etc., depending on your available business data.

8. Risk mitigation and crisis control

Risk is unavoidable for every business, and startups are highly prone to it. If these go unmitigated, they can prevent your business growth or end up closing your venture. CFOs have knowledge about these risks related to internal operations, financial management, external market scenarios, etc. They can advise you on how to control these situations and ensure the smooth running of a business.

9. Financial presentations

You may report to the board about your business financials or meet investors for funding. All of these ask for proper financial presentations, including your projections, present financial model, budgets, etc. A CFO can help you create them properly and explain the theory behind your forecasts and estimations to the board.

10. Legal and compliance management

Outsourced CFO services have worked with multiple industries, so they know the regulations related to your startup. They can assist you in availing government benefits, prevent fraud, and guide you through the statutory laws and government policies.

Evaluating the outsourced CFO services cost

The cost of outsourcing CFO services is cheaper than hiring full-time officers. They charge you hourly or fixed prices for their services, not annual salaries with overheads.

At such low expenses, you gain access to professional expertise, which is no less than that of a full-time CFO. Plus, they give you flexibility in choosing services that your startup needs right now and you can afford.

As your startup grows and your demand changes, scaling up and down your requirements is easy with outsourced CFO services.

All these make hiring outsourced CFO services an attractive option for startups with limited budgets.

FAQs

1. What is the role of a CFO in a startup, and how does it differ from that of a fractional CFO?

A CFO in a startup typically oversees all financial aspects of the business, including financial planning, budgeting, fundraising, and financial reporting. They provide strategic guidance to help drive growth and manage financial risks.

On the other hand, a fractional CFO offers startups part-time or project-based financial leadership, providing expertise and strategic insights without the commitment of a full-time hire.

2. What are the key responsibilities of a CFO in providing financial leadership and strategic guidance to startups?

The key responsibilities of a CFO in a startup include:

- financial planning and analysis,

- fundraising,

- cash flow management,

- risk management,

- financial reporting, and

ensuring compliance with regulations and financial best practices.

They play a crucial role in shaping the financial strategy to support the company’s growth objectives.

3. How does hiring a full-time CFO differ from engaging a fractional CFO on a part-time or project basis?

Hiring a full-time CFO involves a long-term commitment and a higher cost, but it provides dedicated financial leadership and strategic guidance.

Engaging a fractional CFO offers flexibility in terms of time and cost, allowing startups to access experienced financial expertise on a need basis without the overhead of a full-time hire.

4. What are the advantages and disadvantages of hiring a CFO versus a fractional CFO for startups in terms of cost, expertise, and flexibility?

Hiring a CFO provides dedicated expertise but may be costly for early-stage startups. Fractional CFOs offer cost-effective solutions and flexibility but may not be available full-time or on-site, potentially impacting the depth of their involvement.

5. How can startups assess their specific financial needs to determine whether they require a full-time CFO or a fractional CFO?

Startups should evaluate factors such as their stage of growth (bootstrapped, seed stage, series A and so forth), financial complexity, budget constraints, and the level of expertise required to determine whether they need a full-time CFO or can benefit from the flexibility of a fractional CFO.

6. What are the typical scenarios or milestones in a startup’s growth journey that might signal the need for a CFO or fractional CFO?

Milestones such as securing funding, scaling operations, expanding into new markets, or facing complex financial challenges often indicate the need for CFO-level expertise.

Startups experiencing rapid growth or preparing for significant strategic decisions may benefit from the guidance of a CFO or fractional CFO.

7. What should startups consider when evaluating candidates for a CFO position versus engaging a fractional CFO service provider?

Startups should consider the following factors as a minimum when evaluating candidates for a CFO position or engaging a fractional CFO service provider.

- candidate’s experience,

- industry expertise,

- track record,

- time availability,

- flexibility,

- cultural fit, and

- cost

8. How can startups ensure effective collaboration and integration with either a full-time CFO or a fractional CFO to achieve their financial goals?

Effective communication, clear goal-setting, alignment of expectations, and providing access to necessary resources are essential for successful collaboration with both full-time CFOs and fractional CFOs.

9. What are some common misconceptions or myths about hiring CFOs or fractional CFOs for startups, and how can these be addressed?

Common misconceptions include the belief that only large companies need CFOs or that fractional CFOs lack the expertise of full-time hires.

These misconceptions can be addressed through education about CFOs’ value to startups and the benefits of engaging fractional CFOs for specialised expertise.

10. What are some real-world examples or case studies of startups benefiting from the expertise of either a CFO or a fractional CFO, and what lessons can be learned from their experiences?

Real-world examples illustrate how startups have leveraged the expertise of CFOs or fractional CFOs to navigate financial challenges, secure funding, and achieve growth milestones. These examples highlight the importance of strategic financial leadership in driving startup success and provide valuable lessons for other entrepreneurs.

Final thoughts!

If hiring a full-time CFO is expensive for your startup, outsource these services to an agency or hire a fractional CFO. However, make sure you research them thoroughly and see whether they are capable of handling your business.

An experienced CFO can bring numerous changes to your startup and strengthen your financial health.