Self-employed people work in an entirely different way.

If you are a self-employed person and does all the work by yourself, you have to know about so many things to maintain accuracy and have your cash flow intact all the time. VAT applies to you as soon as you hit the VAT threshold set by the HMRC.

VAT stands for Value Added Tax, and businesses that exceed the annual turnover of £90,000 in a financial year has to pay it. This may seem like an extra financial burden, but it is not. You have to know about the ins and outs of it.

This article covers everything that a self-employed person must know—starting from VAT and how it works to its benefits. Know about everything, make sure to read till the end.

- What is VAT, and how it works?

- Is VAT registration mandatory for self-employed?

- When to register for VAT?

- How to register for VAT?

- Benefits of VAT for self-employed people

- How should self-employed owners charge for VAT?

- VAT invoicing

- How to report VAT to HMRC?

- When to submit VAT returns?

- How to submit the returns?

- What is my VAT number?

- How to find VAT number UK?

- Winding-up

Here is our guide on : how to submit a self-assessment tax return.

What is VAT, and how it works?

VAT is a form of consumption tax charged at every stage of the supply chain where any value is added.

For example, a raw materials manufacturer sells a product for processing to a factory, the factory sells the end product to a wholesaler, the wholesaler resells it to a retailer, and the retailer eventually sells it to the end customer for personal consumption.

The retail customer ultimately pays the VAT. In the UK, most prices are displayed as VAT inclusive.

Visit Experlu Vat Number checker UK to check VAT

The subsequent buyer in the supply chain reimburses the buyer at each earlier stage of the product’s development for the VAT.

VAT means a flat charged tax on a product. As said above, once your business crosses the VAT threshold, you have to get registered under VAT with HMRC. Right from then, you have to charge VAT for your customers.

Businesses under VAT will pay it for the products they buy and then pass the same to customers. If you collect more VAT on your sales than what you have paid on your purchases, you must pay the remaining amount to HMRC; if it is the opposite, you can reclaim the remaining tax amount.

In simple words, you (as a business entity) will be charged by the supplier, and you charge the VAT to the customer. Any resulting difference is paid to or claimed from HMRC.

- The VAT you pay on purchases is called input VAT.

- The VAT you collect on sales is called output VAT.

VAT is charged on sales of almost all products and services in the UK. Some exceptions are insurance, bank charges, interest.

Is VAT registration mandatory for self-employed?

Whether you are self-employed, a partnership or a company, you must register for VAT when the previous 12 months’ total sale of taxable supplies exceeds the VAT threshold.

You can register voluntarily if your expected income exceeds the VAT threshold.

When to register for VAT?

A self-employed person or business owner must register for VAT once the annual turnover hits £90,000, which was recently increased from the previous threshold of £85,000. The registration timeline is within 30 days from the end of the month in which you exceed the threshold.

For example, if your total business sales in the previous 12 months exceed £90,000 on 5 September, you will have until 30 October to register. If you hit it on 29 September, the registration timeline is still 30 October. This entire process is called a backward look.

In certain situations, you can estimate future sales in a month, making your turnover cross the threshold. You can register even before you hit the turnover mark, which is called forward look.

Even if you haven’t reached the required turnover, you can still register yourself voluntarily, which has pros and cons.

| Pros | Cons |

| Your business immediately becomes trustworthy, as people assume you make more than £90,000 in turnover every year. | VAT filing requires additional recordkeeping, and you may need the help of a bookkeeper or an accountant. |

| Some companies buy and sell from VAT-registered businesses, and you will get to work with them. | You only have to deal with VAT-registered suppliers to claim input tax. This will hinder some partnerships where you can reap huge margins. |

| You can reclaim the input tax that you have paid to VAT suppliers. | You should start charging VAT, increasing your price by 20%. This can hamper your relationship with trusted non-VAT registered customers. |

How to register for VAT?

The process of registration is the same for both voluntary and compulsory registration.

Log in to your government gateway account and apply for VAT registration to get vat number for company. The date you register, whether forward or backward, is called the Effective Date of Registration.

The process can take up to four weeks, and you will get a VAT registration certificate in the post.

You can ask your accountant to register you for VAT; most will do so for a nominal charge of between £50 and £150.

As soon as you are registered, you are subject to VAT and must charge your customers and pay HMRC.

Benefits of VAT for self-employed people

VAT has many benefits. Some businesses register for VAT even before reaching the threshold to reap these benefits.

Let us see how VAT is going to help self-employed professionals.

1. Reclaim VAT on purchases

The VAT-registered suppliers will always charge you VAT even if you do not charge your customers.

However, if you register for VAT, you can reclaim all of it. You must report the amount your supplier charged you and you charged your customer on your VAT return.

If what you paid is less than what you charged, you can easily get the remaining amount back.

2. No penalty worries

There can be a time when you reach the threshold but are unaware of it. If you hit the threshold mark yet didn’t register your business under VAT, HMRC will penalise you.

However, if you think you will reach the threshold this month or next, you can register voluntarily and not worry about penalties. It is always better to be safe than sorry, right!

3. Backdate your purchases

Once you register under VAT, you can backdate your purchases and claim VAT for the products you brought for business purposes. However, there is a time limit of four years. In simple words, if you purchased a computer system for your business requirements from a VAT-registered supplier two or three years ago, you can claim the amount that you paid as VAT back then after registering.

The maximum you can backdate is four years before the VAT registration date. You can also claim VAT on services you availed for business purposes in the past six months.

Remember that you must have supporting proof to claim VAT here.

How much should self-employed owners charge for VAT?

The standard VAT rate is 20%, and you must charge the same to your customers.

This will help maintain a clear record and reclaim any applicable tax. However, there is a lower tax rate for some essential goods and services and a zero-percent tax rate for others. Let us see how these are classified, and you will know where your percentage will fall.

| VAT % | Rate | Applicable to |

| 20% | Standard | Almost all the taxable supplies |

| 5% | Reduced | Some essential goods and services like energy for houses or car seats for children |

| 0% | Zero Rate | This applies to many essentials such as groceries, books, newspapers, prescriptions, etc. |

| 0% | Exempt | Examples include bank charges, insurance premium |

For more detailed information, you can check HMRC’s official website.

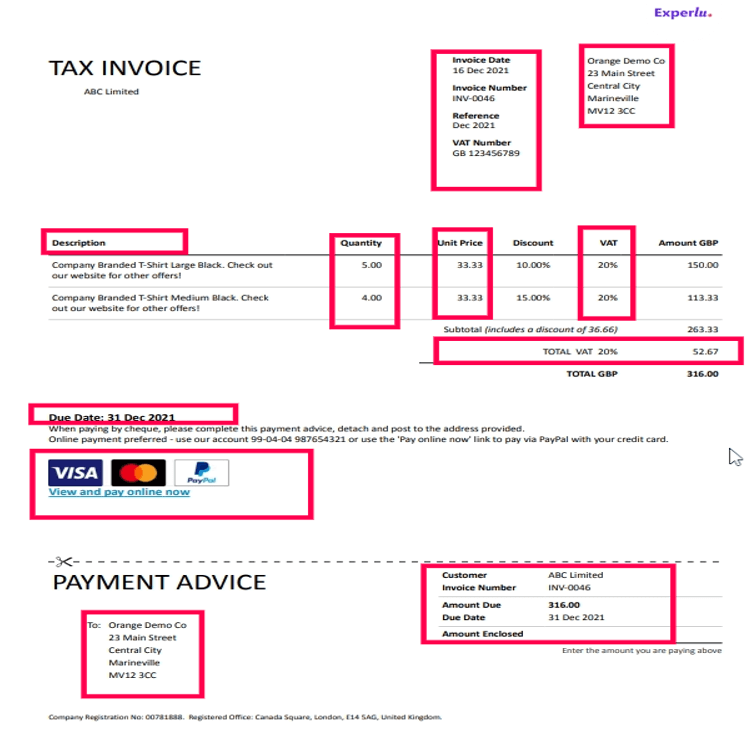

VAT invoicing

Record keeping is essential for VAT-registered businesses. Even if you make an unintentional mistake, HMRC will levy heavy penalties. So, it is always better to be extremely careful with your invoicing.

The following should be present in your VAT invoice without fail.

- Goods or services description.

- Quantity

- Invoice date

- Your business name and address

- VAT registration number

- Date of supply (this can be the date of invoice)

- Invoice number (unique for every invoice)

- Name and address of the customer

- Total amount excluding VAT

- VAT per cent and amount

- Any discount

- Price of each item without VAT

- VAT charged on each item

- Total bill amount including VAT

It is a full VAT invoice and can be modified according to the requirements. But, no matter how you change it, include all the above details. It will help with easy record-keeping and VAT filing in the future.

A sample VAT invoice:

Read our : bookkeeping tips for new business owners.

How to report VAT to HMRC?

The first thing you should have is a VAT account. Here, you will report the VAT you charge and pay.

You must maintain this account accurately for an entire year as it helps with the VAT filing.

Meanwhile, you can use our VAT checker to know whether your business is VAT-registered.

When to submit VAT returns?

Now that you have your VAT account and all the records in hand, let us discuss submitting a VAT return.

The VAT is usually reported to HMRC quarterly, and these three months in a quarter are considered the accounting period. It starts from the month of your effective date of registration. You have the option to choose any three months quarters when registering, i.e.

| VAT quarters | VAT quarter-end | Tax return filing and payment deadline |

| Jan, Feb, Mar | Mar, Jun, Sep, Dec | 7th of May, Aug, Nov, Feb |

| Feb, Mar, Apr | Apr, Jul, Oct, Jan | 7th of Jun, Sep, Dec, Mar |

| Mar, Apr, May | May, Aug, Nov, Feb | 7th of Jul, Oct, Jan, Apr |

You will have one month and seven days to submit the tax return and pay any VAT due after every accounting period. For example, if your accounting period ends on 30 September, you will have time till 7 November to submit the VAT return and pay any VAT due.

This gives you ample time to do bookkeeping and file the return. If you owe HMRC anything under VAT, you should only pay that by this deadline. So, it is advisable to file the taxes in advance.

How to submit the returns?

You have to submit these returns digitally using any MTD-compliant software.

Do you know about: tax-free child care for the self-employed?

What is my VAT number?

A VAT number is a unique identifier issued to businesses that are registered to collect Value Added Tax (VAT) in the UK. It typically consists of nine digits.

Example: If your business is registered for VAT, you might have a VAT number like “GB123456789”.

How to find VAT number UK?

To find your VAT registration number in the UK, check your VAT registration certificate issued by HMRC, your business’s invoices, or your online HMRC account.

Example: If you can’t locate your VAT registration number, you can log into your HMRC account and view your registration certificate.

Winding-up

For self-employed professionals, knowing all essential bits about VAT in advance is essential. The things mentioned above are just for getting started, and there will be a lot of paperwork involved.

You don’t have to worry about either of these things if you are maintaining books properly and have every record handy all the time. If you are confused about all of these things, get the help of a tax advisor.

Leave a Reply