Small businesses can benefit from VAT registeration in various ways, including reclaiming VAT on business purchases and improving their professional image.

Understandably, firms make mistakes on their VAT returns, given the complexity of the VAT laws. These errors can be costly, both in terms of paying the incorrect amount of VAT and triggering a VAT investigation.

We’ll walk you through the most common VAT return problems in this blog post to help you complete VAT returns correctly.

Table of Content

9 Common VAT return mistakes small businesses makes

In theory, VAT, or value-added tax, is a simple concept. It is a government-imposed indirect tax collected by VAT-registered enterprises at every stage with value addition to a product or a service.

It becomes more complex when it comes to filing your VAT return. It is challenging because businesses can choose from various VAT schemes, and the plan you select may impact your VAT rate (i.e. how much VAT you charge to customers or at what rate you pay VAT to HMRC).

The VAT scheme determines how much VAT you must report on your VAT return (whether gross or net income). It also determines what, if any, and how often you can claim input tax.

Several goods and services are either VAT free (or qualify for partial exemption), are not subject to VAT, or are charged at a reduced or nil rate.

A VAT registered business is responsible for determining whether supplies are vatable, how much VAT to assess if you do, and how to report it.

Check our : quick guide to VAT when you are self-employed.

You’re not alone if you’re puzzled. Understanding the nine most common VAT return mistakes made by small businesses and how to avoid them will help you avoid making these yourself.

1. Entering the wrong figures

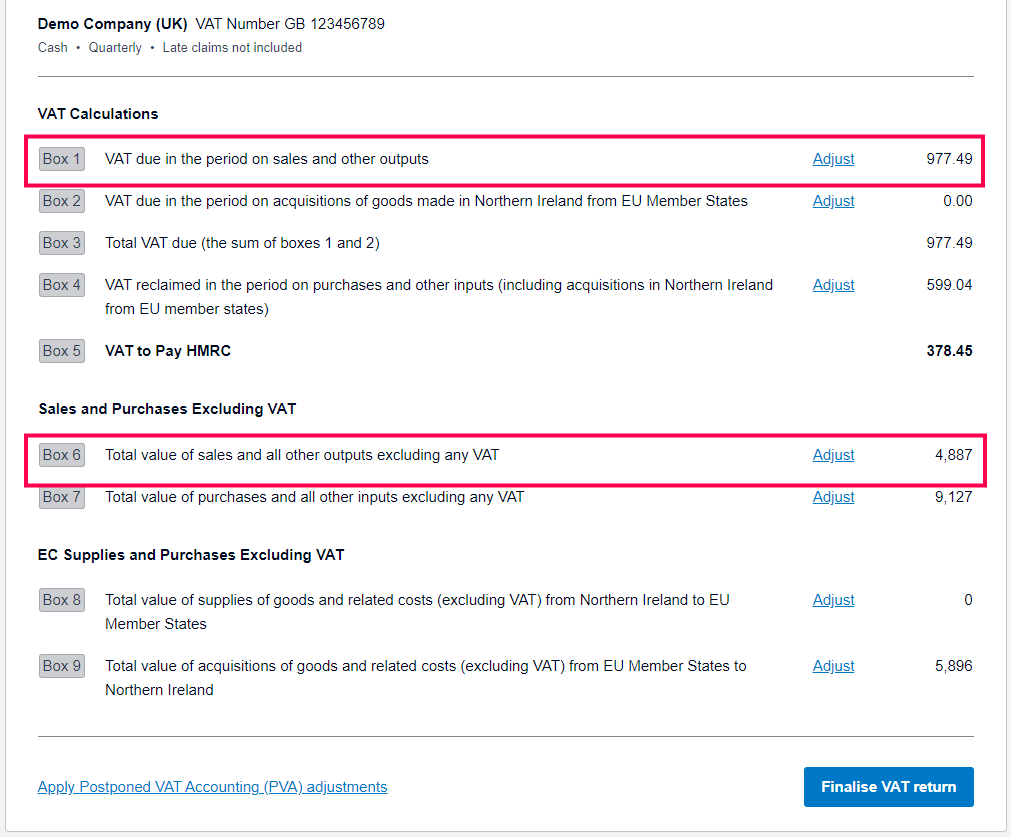

When entering data, the most common errors occur in Box 6 of the VAT return form, which indicates the ‘total value of sales and all other outputs excluding any VAT.’

If you’re utilising the flat rate VAT scheme, the amount in box 6 should be the gross income.

Otherwise, it will reflect net income excluding VAT, whether you’re utilising the cash accounting scheme or the standard accounting scheme.

It’s critical to double-check that the figures in boxes 6 and 1 are correct.

2. Reclaiming VAT on fuel and cars

You can reclaim VAT on fuel purchased for commercial reasons by directors, partners, and employees on a VAT return.

When fuel bought for personal use is claimed alongside fuel purchased for work travel, which is typical when a vehicle has dual business and personal service, it is a common VAT return mistake.

Since HMRC requires accurate mileage records to back up a claim, unless maintaining records is too difficult, in which case you can pay a scale charge as output tax to account for fuel used for personal travel.

3. Not charging VAT on non-standard supplies

Essential company purchases, such as inventory and office supplies, are commonly subjected to VAT.

Cash sales, property income, management fees, and barter transactions are generally mishandled, resulting in too little, too much, or no VAT reclaimed.

So make a point of highlighting any new or unique transactions so that you can check that they receive the correct treatment.

Check our guide on : A Complete Guide to VAT Codes the Full List.

4. Reclaiming VAT on aged creditors

Bad debt occurs when the output tax has been accounted for on a supply made and doesn’t receive payment from the customer after six months.

It is a well-known debt relief rule.

You can’t file for bad debt relief until six months after the due date.

If your business has reclaimed input tax on bills received from suppliers but has not paid after six months, you must reimburse the input tax to HMRC.

5. Reclaiming import VAT too early

The most typical error made with import VAT is claiming VAT on receipt of bills from shipping agencies. While these invoices are acceptable, they only account for the agent’s fees and not the import VAT for claims.

After receiving a certified import VAT certificate (C79) from HMRC, you can claim import VAT. Typically, it occurred three weeks after the end of the month when agencies delivered the products in the UK.

Wait to file a claim until the C79 certificate verifies that you are the rightful owner of the goods.

6. Reclaiming VAT without invoices

You must produce evidence in the form of a VAT invoice to reclaim VAT on any business expense. As a result, you must get all paperwork in order and follow up on any outstanding or late invoices before filing your tax return.

If you can’t find a copy of a VAT invoice, HMRC may accept alternative evidence, such as a bank statement proving you made the payment to a supplier.

However, a common rule is that there is no evidence, there is no claim.

7. Claiming on purchases that are zero-rated or partially VAT exempt

Given the usual VAT rate (20%) is included in many of the primary and regular purchases you make for your business, it’s fair to assume that you can recover VAT on all business expenses. However, That isn’t always the case.

Some acquisitions, such as selling, leasing, and letting commercial property and buildings and membership dues to organisations, are exempt from VAT and cannot be included in a VAT return.

Personal expenses are also exempt, though you may be able to reclaim a portion of the VAT on an item that serves both business and personal use.

If you buy a laptop to use at home and work, for example, you may figure out how much of the purchase is business-related and claim VAT.

What is the differentiation between zero-rated and VAT-exempt?

The GOV.UK website has comprehensive UK VAT rates for various goods and services.

8. Reclaiming VAT on entertainment

Many businesses require entertaining a new or current client as a relationship-building strategy to help them develop their business and promote their brand.

Given that you’re effectively spending money on marketing, it seems normal to be able to reclaim VAT.

Unfortunately, HMRC disagrees, and you cannot reclaim input tax on any business entertainment. It includes the following:

- ● Food and beverage

- ● Accommodation

- ● Entry to events or shows

9. Reclaiming VAT on deposits

Businesses also make the error of recovering VAT on deposits rather than waiting until the whole balance is received.

Fortunately, as simple as this error is to make, it’s also simple to avoid by understanding that any payment received generates a VAT tax point.

If your company accepts a deposit or down payment from a customer for products or services, VAT is due when that money is received, unless you have previously issued an invoice.

How to avoid VAT mistakes

While there’s no perfect way to avoid mistakes, understanding VAT and having a system in place that makes submitting taxes as easy as possible might help.

1. Understand VAT schemes

You’ll be able to choose the best VAT scheme for your business and guarantee the figures on your VAT return are correct if you understand the three primary VAT schemes for small businesses.

2. Flat rate VAT scheme

You charge clients or customers the usual VAT rate (currently 20%) but pay HMRC a reduced rate.

You cannot claim VAT on any expenses other than capital equipment if you take advantage of this low rate.

The principal benefit of this scheme is the simplicity and reduced record keeping. This scheme has specific restrictions, like which business can apply and the turnover threshold.

- ● Cash accounting VAT scheme

Only the money you’ve paid and received is subject to VAT.

- ● Standard accounting VAT scheme

Whether the client or the customer paid you or not, you must pay VAT on sales.

Therefore, you can claim VAT on supplier invoices whether or not you have paid the bill.

When you register for vat, the VAT schemes you are eligible for are determined by your taxable turnover and decide how often you can reclaim VAT.

3. Put someone in charge of VAT

Having someone dealing with VAT would help avoid tax confusion and guarantee that records are accurate.

If you’re familiar with VAT and the different rules, you can take on this responsibility yourself by filing the returns using accounting software.

If not, assign the responsibility to someone who has the necessary knowledge and ability to keep your VAT compliant.

Indeed, an accountant is the best option.

4. Keep up to date with HMRC changes

VAT is constantly changing. The flat-rate plan and Making Tax Digital are two recent innovations that have changed how small businesses deal with VAT.

With the current crisis surrounding COVID-19 and the United Kingdom’s withdrawal from the EU (Brexit), as well as HMRC’s push to make VAT easier for VAT-registered businesses, new rules and regulations are going to emerge.

Wrapping up

We hope the ways mentioned above will guide you and help you not make any mistakes while filing the VAT for your small business. If you know where errors happen regularly, you can easily avoid them.

You can limit your risk of making a mistake to reclaim what you’re entitled to by learning where VAT return errors typically occur and what HMRC expects of you.

Leave a Reply