If you are a higher-rate taxpayer or have untaxed income, you will probably have to file a Self-Assessment Tax Return.

But unsure how to pay self assessed tax return?

Table of Content

- What Is Self-Assessment Tax Return?

- Who Needs To Complete Self-Assessment Tax Return?

- Register For Self Assessment

- How To File Self Assessment Tax Return

- The SA100 Income Section

- Supplementary Tax Return Pages

- For Self Employed

- The UK Property

- The Capital Gains

- The Self Assessment Tax Bill

- Payment Of The Self Assessment tax

- What is the Self Assessment tax return deadline?

- Penalties for late filing

- Quick Tips For Self Assessment Tax Return

What Is Self-Assessment Tax Return?

The main purpose of Self Assessment is to declare all income for a tax year to HMRC to make sure that the right amount of income tax is paid.

In simple words, a Self Assessment is HMRC’s way to find out how much Income Tax and National Insurance an individual needs to pay on any income which is not taxed at source.

Generally, employees have their income tax automatically deducted from their employment income through the PAYE scheme.

This does not happen for self-employed, or for other types of income, like pensions or income from investments and savings, which is where the Self Assessment comes in.

Therefore, it’s very important to be aware of working out your tax liability so that money can be put aside to pay HMRC.

Visit our blog tips for starting year-end tax planning to simplify your tax planning.

Who Needs To Complete The Self Assessment Tax Return?

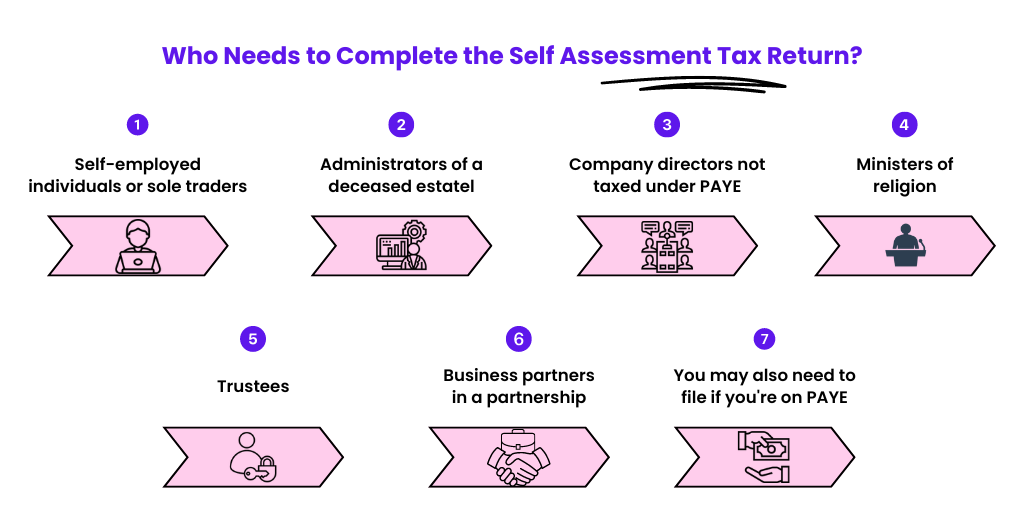

Individuals who are required to file a Self Assessment tax return include:

- Those who are self-employed or sole traders

- An administrator of a deceased’s estate

- You are a company director, and your income is not taxed under PAYE

- A minister of religion

- A trustee

- A partner in a business partnership

Also, even if you’re on PAYE, you may need to complete Self Assessment if:

- You’ve additional income from property, investments and other sources

- You have taxable foreign income

- You have an annual income of over £150,000 (£100,000 for tax year 2022/23 and before)

- You or your partner are receiving child benefits, and your income is over £50,000

- Your claims for expenses are over £2,500

- You have capital gains

There may also be other reasons as to why you need to send a Self Assessment tax return.

Registering For Self Assessment

Before completing the first tax return, you must register for the Self Assessment Tax Return.

Once you have registered, HMRC will set up the right records for you to ensure you pay the right amount of tax and National Insurance.

When an individual identifies the reason for filing the Self Assessment Tax Return, they must inform this to HMRC.

You can do this by completing either the online HMRC form or downloading and posting a completed SA1 form to HMRC.

After the registration for self-assessment, HMRC will send you a Unique Taxpayer Reference (UTR) number.

With the use of UTR number, you can be able to set up your government gateway account.

Once your government gateway account is up and running, you can log in and submit your tax return.

How To File Self Assessment Tax Return?

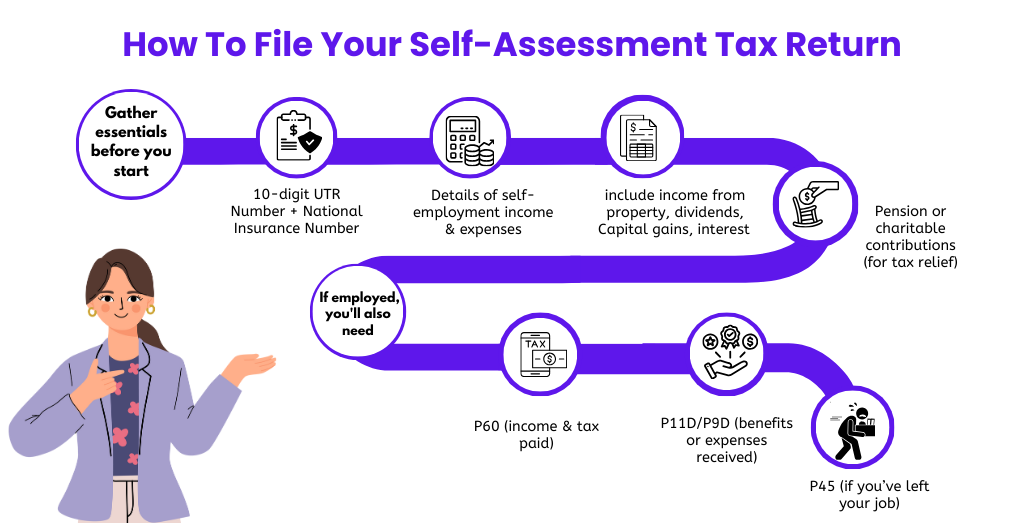

Wait! Before you sit down to complete your tax return, make sure you have everything you need on hand. This will make the process more straightforward.

Let me tell you what you will need:

- Your 10-digit UTR number + National Insurance Number

- Details of any self-employment business expenses

- Details of income from self-employment, including bank statements, dividends and interests on shares

- Details of any pension or charitable contributions for tax relief

If you earn an income through employment, you will also need:

- P60 from your employer showing your income & the tax you have already paid

- P11D or P9D showing any benefits or expenses you received

- P45 if you’ve left your job during the tax year

As long as you’ve accurate records of your income and expenses, filling in the tax return will be no more headache than completing any regular expense form.

Now, all you have to do is enter all the information, and the system will take care of the rest.

The tax self-assessment tax return has a main section (SA100) and supplementary sections for income from other sources you have not paid tax on.

The SA100 Income Section

This section contains income from sources other than self-employment or employment and any pension or charitable contributions you have made.

This includes:

- Pension, annuities & state benefits

This covers details on the total and gross amounts of State Pension, the gross amount of other pension lump sums and details on benefits, such as Incapacity Benefit, Jobseeker’s Allowance, Industrial Death Benefit, Bereavement Allowance etc.

- Blind Person’s Allowance

You must note whether or not you are claiming this.

- Student Loan Repayments

You must note whether or not you are repaying a student loan and details of deductions made by the employer.

- A Marriage Allowance

In case your income for the tax year was less than a Personal Allowance, you can transfer the remaining allowance to your spouse.

- High-income Child Benefit

You must complete this section if you earn more than £50,000 and receive Child Benefit.

- Charitable donations

Details of all Gift Aid donations.

- Pension contributions

Details about all payments made into a registered pension scheme or annuity contract where contributions were made after tax.

Supplementary Tax Return Pages

If you are self-employed, have capital gains to declare, or earn income from property, you will need to complete the important supplementary pages below.

- Self-employed – SA103 form

- UK property – SA105 form

- Capital Gains – SA108 form

Each of these forms is divided into two sections: income and expenses.

For Self-Employed

Your income is everything you have earned through self-employment during the tax year, before expenses.

If you have other incomes, you must enter the one you earn the most from as the main income.

For instance, if you worked as a freelance web designer and earned £20,000 selling your services and £8,000 through your side hustle, you would have listed your web designer income as the primary income.

Your expenses are anything you have spent on your business in the last tax year.

The UK Property

Your income is the total amount you have earned from any furnished holiday lettings and from any other properties you put on rent.

Expenses can be the costs of maintaining and owning property unless you claim the trading allowance.

The Capital Gains

In the case of capital gains, your income is the total disposal proceeds for residential and non-residential property, shares, and securities.

Expenses can be claimed for the allowable costs of buying and improving assets.

Let’s understand the Self Assessment tax bill

After filing the self-assessment tax return, you will get a bill from HMRC in case you owe any tax.

Generally, it takes up to 72 hours after submitting your return for a final tax calculation to appear in your account.

The self-employed may need evidence of their earnings for various purposes, such as renting an apartment or applying for a mortgage.

If so, you can also request your SA302 tax calculation, which shows earnings over the past four years and an overview for the specific tax year.

Payment Of The Self Assessment Tax Return

In case you owe the tax, HMRC will tell you the exact amount you need to pay.

You can pay your tax bill by:

- Bank transfer – CHAPS or Faster Payments

- Paying-in slip from HMRC

- Debit cards

- Cheque

- Direct Debit

You cannot pay your tax bill using a credit card.

What is the Self Assessment tax return deadline?

The tax year in the UK runs from 6 April to 5 April the following year.

So, for instance, the 2023-24 tax year covered a period from 6 April 2023 to 5 April 2024 which means the postal deadline is 31 October 2024 and the online deadline is 31 January 2025. Late submission of the tax return will incur penalties.

It is crucial to remember that 31 January is not just the deadline for completing your return – it is generally the date you’ve to make your tax payment along with the first payment on account to the HMRC. The following payment is usually due on 31 July.

The deadlines for submission to HMRC:

- 31 October for the postal submissions

- 31 January for the online submissions

Penalties for late filing

HMRC allows nearly ten months from the tax year-end to file the Self Assessment Tax Returns—but do not leave it that late!

Because as soon as the return is one day late, HMRC will automatically issue the first penalty and will continue with additional penalties until you file the return.

| Tax Overdue by | Penalty | Notes |

| One day | £100 | This applies even if there’s no tax to pay or if a tax due has been paid, but a return hasn’t been filed. HMRC has waived the penalty provided you file our tax return by 28 February 2021. However, interest will be payable on any unpaid tax liability. |

| Three months | £10 for each following day | Up to the 90 day maximum of £900. This is in addition to the penalty mentioned above |

| Six months | £300 or 5% of tax due, whichever is higher | This is in addition to the penalties mentioned above |

| Twelve months | £300 or 5% of tax due, whichever is higher | In serious cases, they may apply a penalty of up to 100% of the tax due |

Quick Tips For Self Assessment Tax Return

- Get registered for Self The Assessment as soon as possible

Don’t leave it too close to the deadline. As HMRC says, it can take up to 10 working days to receive the UTR and up to 10 additional days to receive your activation code. So keep in mind to register at least one month before the deadline.

- Don’t rush

You don’t have to complete the Self Assessment return in one go. You can save your progress and can come back to it.

- Keep accurate records

Just don’t throw anything away, either. As a taxpayer, you have to keep records for at least a year after filing taxes. If you are self-employed, you must have records for six years.

- Check & check again

Before hitting submit on your tax return, go back through each section to ensure you’ve completed everything you need to.

- If you’ve made a mistake

You can make changes up to the Self Assessment deadline the following year.

- Download HMRC’s help sheets to assist you with each tax return section.

Leave a Reply