Turnover: Knowing how good your business is doing at any stage is essential forvarious reasons.

And Turnover is the most elemental measure of business performance.

It’s probably one of the most straightforward metrics to get a quick image of how well a business is doing.

It is crucial to understand Turnover, alongside costs, to understand how much you need to reach the earnings you are targeting.

Here is our quick guide with an explanation ofprecisely what Turnover is, why it matters, and how to differentiate it from profit.

This Blog Post Is Divided Into Following Sections

- Definition of Turnover

- What is Turnover?

- Difference between Turnover and profit

- How to calculate Turnover?

- How to calculate the VAT Turnover?

- Why Knowing Turnover Matters?

Definition of Turnover

According to the Companies Act 2006, Turnover is “The amount derived from the provision of goods and services after deduction of Value added tax (VAT), trade discounts, and any other taxed based on the amounts so derived.”

To put it another way, we can think of Turnover as the amount you invoice your customers for the sale of service or product, excluding VAT and any discount.

What Is Turnover?

Turnover is nothing but how much money a business has made over a period of time, not how much profit it has made but just the total of all your business sales.

Generally, you can make lots of money turnover-wise while also making a loss.

Imagine buying a million caps for £10 each and selling all of them for £1 each.

Bravo, you’re a millionaire! You’ve ‘turned over’ a million pound and at the same time lost £9 million, which is not great.

What Is The Difference Between Turnover & Profit?

Both profit and Turnover in business measure earnings. But Turnover measures it before taking out high costs while profit is residual earnings after expenses.

You can also view it as the money your business gets to keep after reducing the net sales figures by all expenses.

Still fuzzy on these two terms? Let’s have a deep insight.

| Turnover | Profit |

| Usually, it is the first line of the income statement or profit and loss account. | Usually, it is the Last line of the income statement or profit and loss account. |

| Refers to the net sales of a company generated through business transactions during the financial year. | Refers to the net residual earning after deducting all the expenses. |

| It mainly tells about the demand for a product and services of the company in the market. | It tells the amount of money available for an investor to take home- usually dividends. |

Is Turnover More Important Than The Profit?

Business experts love to say that theTurnover is vanity, but the profit is sanity.

It simply means that while the massive sales turnover looks impressive, there is rarely a commercial benefit to this unless it creates the profit.

But there are some exceptions.

For instance, a business might priorities building up its market share or customer base in its early stages, which can lead to a chunky turnover despite minimal profits of any type.

Many tech world businesses are valued at multiples of earnings- EBITDA, Earnings before interest, tax, depreciation, and amortisation.

How to calculate Turnover

As we have seen above the Turnover is the total sales that your business generates in a specific period,or we can say in a financial year.

It is relatively easy to work out the Turnover.

Provided you keep accurate records of all the sales invoices, you can add these up easily using the sum tool in the spreadsheet such as Excel, or your invoicing or accounting software. Xero does this automatically for you.

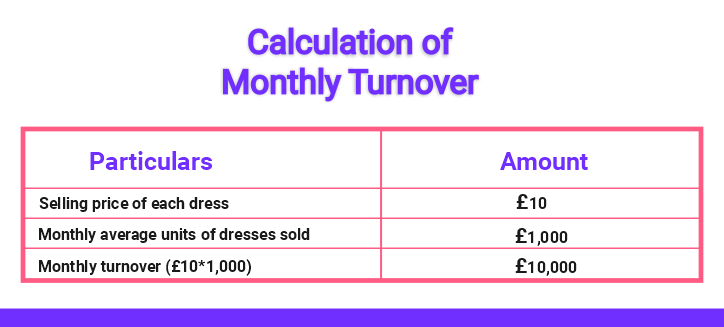

Let’s say a trader of clothing items sells a piece of dress for £10 excluding VAT.

Now on average, the trader sells 1,000 dresses per month.

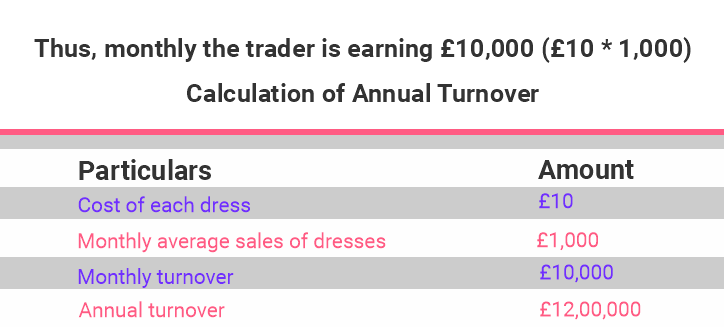

- Thus, monthly the trader is earning £10,000 (£10 * 1,000).

Calculation of Annual Turnover –

- = 12*£10,000

- = £120,000

Thus, the annual Turnover is £120,000

This annual Turnovernumber is the sales figure before deducting the purchase, direct expenses, and before adding non-operating incomes or other indirect incomes. Thus it’s a gross figure.

- to work out a net profit, take your gross profit and deduct all other expenses – not forgetting your tax liabilities

In the above example if expenses including tax are £30,000 then,

Net profit = Turnover – operating expenses

£120,000 – £30,000

Net Profit = £90,000

How to calculate The VAT turnover

For businesses operating in the UK, another reason to measure Turnover is to determine whether they need to become VAT registered.

If your revenue is near £90,000, you must measure the taxable VAT turnover.

It is the total value of everything you sell that is ‘VATable’ – that is, sales that are not VAT exempt.

If this figure exceeds the threshold over any rolling 12-month period, you must register for the VAT and charge it on your services.

It is not a fixed period like the tax year or the calendar year; it could be any 12-month period, for instance, June’s start to the end of May.

Some businesses register for the VAT even if Turnover is under the threshold – for instance, if their revenue has temporarily dipped under £90,000, or because it makes them look like a larger company.

If your business is registered for VAT, the sums you invoice and receive include VAT, but your Turnover is total sales, excluding VAT. This is because your company has not earned the VAT element. You must pay that over to HMRC quarterly.

Why Knowing The Turnover Matters

Knowing Turnover allows you to compare it to profits and make informed decisions about running a business more efficiently.

For example, if the Turnover is high, but the gross profit is low, you can try to renegotiate with your existing supplier to reduce the costs, look for another supplier or increase the selling price.

If net profit is low relative to Turnover, you should review your administrative costs and tax arrangements.

Are you claiming all the business allowances you’re entitled to?

Let’s Sum It Up

Overall, turnover is a vital measure of a company’s health, but don’t confuse it with profit.

Profit is a measure of earnings and is the total sales minus the costs of the business.

As the saying goes, ‘Revenue is vanity, profit is sanity’ – in other words, no matter how good your sales are, you cannot run a successful business without good profits.

Leave a Reply