As a self-employed business owner, you’ll need to know a lot about accounting to keep your records accurate and grow your cash flow. You can begin charging VAT after you reach a specific level of annual taxable turnover.

It’s easier to manage VAT when you understand the ins and outs of the system. So we’ll look at what VAT is and how it works in this blog post. We’ll also go through how to become VAT registered and charge and report VAT as a self-employed person.

What is Value Added Tax (VAT), and how does it impact self-employed individuals?

You’ve probably heard of Value-Added Tax or VAT when purchasing something.

It’s a flat tax on a product or service, paid at each manufacturing, distribution, and sale stage.

VAT-registered businesses invoice, collect or pay tax on any VAT taxable goods and services they buy or sell. You report VAT collections or payments to HMRC via VAT returns, usually submitted quarterly.

Is it necessary to register if a person is self-employed?

When it comes to VAT registration, self-employed people, including freelancers, are subject to the same rules as businesses or companies. You must register and begin charging VAT if you meet the registration criteria.

When and how to register

Once a business (including self-employed businesses) annual turnover exceeds £85,000, it must register for VAT.

Once you reach the threshold, you must register for VAT within 30 days after the end of the month in which you reached it. It’s referred to as the backward look.

Suppose you received a payment on October 5th that pushed you over the £85,000 mark (indicating you’ve now sold more than £85,000 worth of goods or services since October last year). The deadline to register for VAT is currently November 30th.

The same is applicable if you crossed that line on October 28th. The deadline to register for VAT is November 30th.

What is a forward look?

If you expect your sales to exceed the minimum threshold, you must register. It is called the forward look.

If you expect your sales to exceed £85,000 in a year, you must register within 30 days. It happens when you land a deal that will push you over the threshold when payment is complete.

Even if you haven’t achieved the earnings threshold, you can still register. There are numerous benefits and drawbacks to voluntarily registering for VAT.

Advantages and disadvantages of VAT registration

VAT registration makes your firm appear more credible in the pro column, as others will assume you’re earning revenue above the VAT threshold. It’s also helpful if you are charged VAT from suppliers and want to reclaim it.

In terms of disadvantages, you’ll have to start charging VAT to your clients, which would likely raise your pricing by 20%. In addition, it could upset consumers and businesses that are not VAT registered.

It also increases the paperwork you maintain and file throughout the year.

Whether you register voluntarily or because you’ve reached the threshold, the process is the same.

GOV.UK is where you (or your agent or accountant) may register your business for VAT. Your Effective Day of Registration is when you hit your backward or forward look date.

You charge VAT once registered.

Benefits of VAT registration when you’re self-employed

Being VAT registered comes with several benefits. First, as previously noted, businesses may choose to register before they reach the turnover threshold.

Following are some of the benefits of VAT registration for a sole trader.

1. You reclaim VAT paid on business purchases

Even if you don’t charge VAT, some of your suppliers most certainly do. When you register, you’ll be able to deduct that cost from your VAT returns.

You must disclose both what you pay and what you charge in VAT for each return. You can then claim the difference between what you charged clients and what you paid suppliers as a refund on your return.

2. You’re exempt from penalties if you exceed the VAT threshold

If you’re not careful, you could unknowingly exceed the registration threshold. If this occurs and you do not register by the deadline, HMRC will impose a penalty for failing to comply with the VAT obligations.

On the other hand, if you’re on the verge of hitting that milestone, voluntarily registering can help your business save money in the long run.

3. You boost your company’s reputation

Being VAT registered might help you stand out in a competitive market by enhancing your company’s brand. Displaying your VAT registration number on marketing materials and your website and charging VAT on invoices demonstrates that you’re a trustworthy and profitable company. In addition, showing that you operate as a well-established corporate entity will boost your professionalism.

Charging VAT as a self-employed business owner

If you want to reclaim a portion of your VAT, you must charge the correct VAT rate. That means finding out how much to charge for goods and services. You should also keep track of the charges on your invoices.

How much should I charge?

Certain goods and services are not taxed because they are exempt from VAT. Because these items benefit the general people, the government wants to keep them inexpensive. Charitable organisations, energy and medical service providers, education suppliers, finance, insurance, and investment service providers are among these. To figure out how much VAT should be charged, you can use a VAT checker.

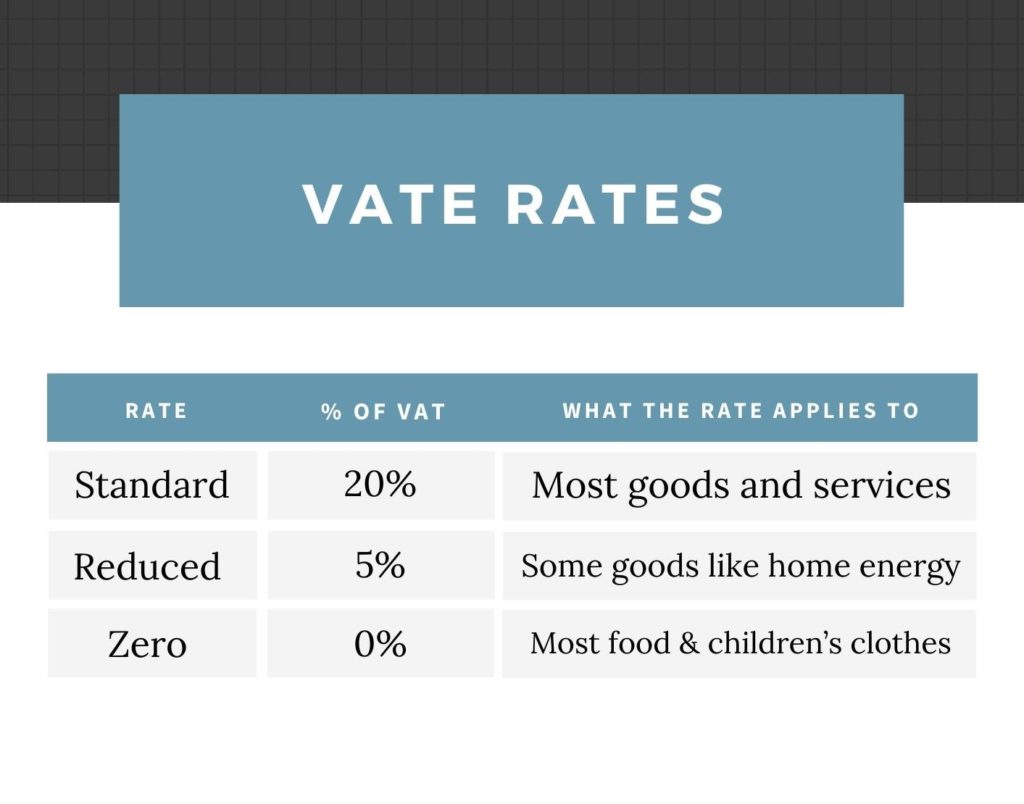

Everything else is subject to VAT, and you’ll have to figure out how much to charge. In the United Kingdom, there are three different VAT rates for businesses:

Standard rate (20%)

It is valid for the majority of goods and services. Any non-exempt sales that do not qualify for reduced or zero rates should be charged at this rate.

Reduced rate (5%)

Some goods and services, such as domestic electricity and children’s car seats, are subject to the lower rate.

Zero rate (0% )

It holds for necessities like food items (excluding restaurant meals), children’s clothing, books and periodicals, medications, and new home sales.

Exports are usually zero-rated.

While zero-rate items are not subject to tax, they differ from exempt goods in that you can still claim VAT credit on your return.

Reporting and paying VAT to HMRC

You must know when and how to file returns to be in good standing and pay and reclaim VAT. Here, we’ll go through the fundamentals of filing returns, including which VAT scheme to use and how Making Tax Digital affects your returns.

Submitting VAT returns

You must keep track of the VAT you charge and pay in a separate VAT account, which you will use to file your returns. It is a crucial accounting component that you’ll keep track of throughout the year to ensure proper tax returns.

When to submit returns

Every accounting period—usually quarterly—you report VAT to HMRC by completing a VAT return. When you first register for VAT, you can specify when your quarterly period begins.

Every accounting period’s returns and payments are due one month and seven days following the end of the period. If your accounting period closes on March 31st, your return must be filed by May 7th.

If you owe money to HMRC, it must also be in their account by this date. So, to prevent missing it, plan to file your return and make the transfer ahead of time.

How to submit returns

Under MTD, most returns are submitted digitally by using an HMRC approved tax software. However, you can open a VAT online account once you’ve registered and obtained your VAT number from HMRC.

You must include the following information in your return:

- All of your purchases and sales for the quarter

- The amount of VAT you owe

- The VAT you can reclaim

- The amount of your VAT refund due from HMRC

- Purchases from and sales to countries outside the UK

Final thoughts

Understanding your VAT responsibilities and benefits as a self-employed business owner is critical to keeping your finances in order. There are many moving parts and extra paperwork, but you can manage your VAT returns if you plan and keep track of everything.

Reporting your returns will be easier and faster if you use online software to assist you in keeping track of your VAT records.

Leave a Reply