Capital gains tax (CGT) in the UK is applicable when you sell a property and makes a profit. However, it is not related to primary homes but applies to second homes and buy-to-let properties.

There are opportunities for such individuals to reduce the amount of CGT under certain conditions.

The number of years you live in a property affects the CGT allowance amount for residential properties. We can say that the longer you live in a property, the more CGT relief you receive.

Here is a handy guide for property sellers to understand how long you have to live in a property to avoid capital gains tax UK. We’ll cover the following areas:

● What is capital gains tax?

● How long do you have to live in a property to avoid CGT?

● Who is eligible for the Private Residence Relief?

● How to claim the PPR?

● Wrapping up

What is capital gains tax?

The capital gains tax is a tax applicable on your profits after selling a property in the UK.

Generally, CGT implies selling a buy-to-let property or your second home. Individuals must pay partial CGT if they use a part of the home as a business premise.

The basic rate of CGT is 18% on profits. At the same time, the higher and additional CGT rate is 24% (2023-24: 28%). Every capital gain adds to your income sources and falls under the income tax bracket for the financial year.

The tax-free capital gains for 2024-25 is £3,000 (2023-24: £6,000). Any income above this level charges CGT on individuals. A couple can jointly make a tax-free capital gain of £6,000 (2023-24: £12,000).

To calculate Capital gain tax you can use capital Gain Tax calculator UK.

How long do you have to live in a property to avoid CGT?

Capital gain tax on property : – You must be a resident of the property for the entire period of ownership to save on CGT. No Capital Gain Tax is applicable on your residential property if you live there as your primary and only residence. It is known as the Private Residence Relief (PRR).

You must reside in the property for at least one year to make it your permanent residence. You can move to a different place for specific reasons. According to the HMRC, you qualify for PRR,

● For the period you are living in the property, and

● The last nine months of your ownership period if you no longer live there.

Can we extend PRR?

You can move back into the home to extend PRR under certain conditions:

● You didn’t occupy your new home for 12 months as you can’t sell the old property.

● You have been waiting in the old property for 12 months due to the refurbishment of the new residence.

● You may be absent for 36 months for some reason and move back immediately after the period.

● You are working at a different place far from your home; the PRR considers 48 months of absence, but you must return after that period.

● If you work in an overseas company, PRR considers an unlimited absence. You must return unless you permanently settle there and sell the old property.

Does PRR apply to commercial property?

No, this relief does not apply to commercial properties. If you have a residential property, or more than one, you are eligible for PRR.

If you use the whole or part of your dwelling to make a profit or use it exclusively for business, no relief is applicable on the capital gain tax.

Who is eligible for the Private Residence Relief?

Individuals can qualify for Private Residence Relief – PRR if they profit from selling their only primary residence.

You are also eligible for the relief if,

● If you own the freehold of your home

● You are a tenant having a leasehold

● You jointly own a freehold or lease with someone else

How to calculate the Private Residence Relief amount?

The relief amount depends on the number of years you stay in the property.

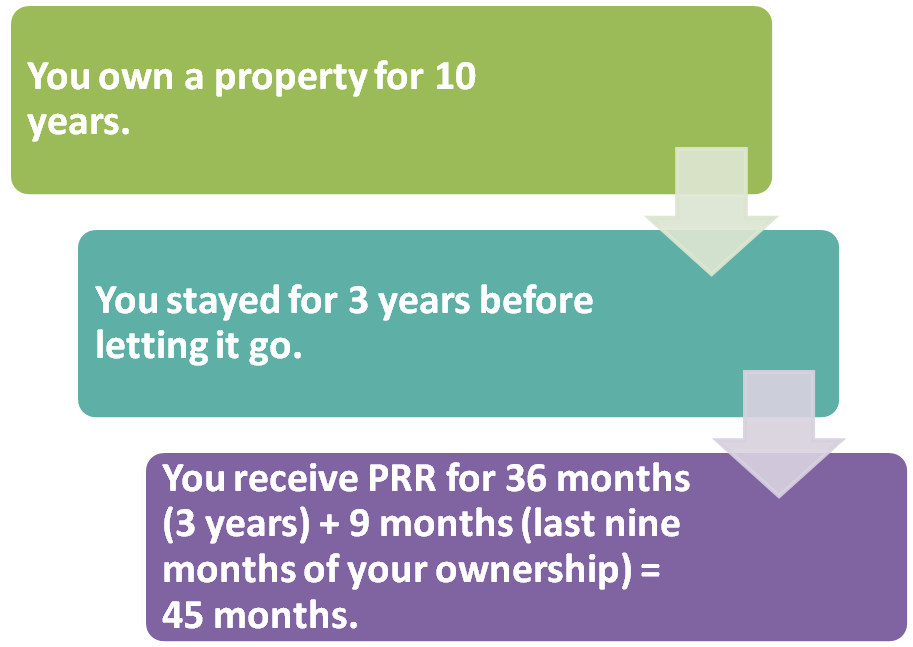

Let us take an example,

● You buy a residential property for £200,000 and sell it for £300,000 after ten years (120 months). You make a taxable gain of £100,000 on the sale.

● You lived in the property for the first three years and then let it out.

● The PPR is applicable for these three years and the last nine months of your stay there.

● You’ll get PPR for 45 months (36 months + 9 months), which is 37.5% (45 months divided by 120 months) of the total time. So, the relief amount is 37.5% of the profit, i.e., £37,500.

● The remaining 62.5% of the gain of £62,500 is the chargeable CGT, as PPR doesn’t cover this part of your profit.

If you sold the property between 6th April 2014 and 6th April 2020, you got PRR for the last 18 months of your stay in the residential property. However, from 6th April 2021, you will receive PRR for the last nine months of ownership.

How to claim the Private Residence Relief PPR?

1. You have used a part of your property as a home

If you share a part of your property with tenants, you can claim relief for your dwelling section.

For example, you lent a room in your house that comprises 10% of the total property.

Now, you want to sell the property and reduce CGT. You can claim relief for only the remaining 90% of your dwelling property, and 10% is chargeable.

2. You have lived for a few years

You can claim PR only for the time you have lived on the property. Under certain circumstances, HMRC can consider your absence in the residential property.

3. Your property is development value

PPR applies only to the actual value of your property, excluding its development value. Here, you have to calculate the partial PPR by deducting a part of your expense from the current use value of the property.

After calculating your Capital Gain Tax and the PRR, report it to the HMRC before 31st January every year.

How much is property gains tax in the UK?

The Capital Gains Tax (CGT) rate for property in the UK is 18% for basic rate taxpayers and 28% for higher rate taxpayers.

For example, if you sell a second property for a gain of £50,000, a basic rate taxpayer would pay £9,000 (18% of £50,000), while a higher rate taxpayer would pay £14,000 (28% of £50,000).

Capital gains tax threshold

For the 2023/24 tax year, the CGT annual exempt amount is £12,300. This means the first £12,300 of capital gains is tax-free.

For example, if you sell an asset and make a gain of £15,000, only £2,700 would be taxable (£15,000 – £12,300).

What is property gains tax?

Property gains tax is a tax on the profit made from selling property or an investment that has increased in value. The tax is only on the gain, not the total amount of money received.

How to avoid paying tax on rental income

To avoid or reduce tax on rental income, you can claim allowable expenses such as mortgage interest, property repairs, insurance, and management fees.

For example, if you receive £12,000 in rental income but have £4,000 in allowable expenses, you’ll only be taxed on £8,000.

How to calculate capital gains tax

To calculate CGT, subtract the cost of the asset and any allowable expenses from the sale price to find the gain. Then, subtract the CGT annual exempt amount and apply the relevant tax rate (18% or 28% for property).

| Description | Amount (£) |

| Purchase Price | 100000 |

| Sale Price | 150000 |

| Allowable Expenses | 5000 |

| Gain | 45000 |

| Annual Exempt Amount | 12300 |

| Taxable Gain | 32700 |

For example, if you bought a property for £100,000, sold it for £150,000, and had £5,000 in allowable expenses, the gain would be £45,000. Subtract the annual exempt amount of £12,300 to get a taxable gain of £32,700.

When do you pay capital gains tax?

You need to report and pay any CGT owed on UK property within 60 days of selling it. For example, if you sold a property on March 1, 2024, you must report and pay the tax by April 30, 2024.

How to avoid capital gains tax on inherited property in the UK

To reduce or avoid CGT on inherited property, you can use strategies like selling the property immediately after inheriting it (if its value hasn’t increased significantly), living in the property and making it your primary residence, or using your CGT annual exemption.

For example, if you inherit a property valued at £200,000 and sell it for £210,000 within a short period, the gain might be minimal and covered by the annual exempt amount.

Wrapping up

HMRC Capital Gains Tax is one of several taxes an individual pays to HMRC for a property. Others are council tax, income tax on rental property rent, and inheritance tax on property gifts.

Due to their complexity, taxes may become difficult for people to understand. They can consult with tax advisors to better understand CGT and similar taxes.

Leave a Reply