The United Kingdom is witnessing an increased demand for electric vehicles (EVs). It is mandatory, too, as a part of the global necessity for sustainable transportation.

Table of Content

- Factors Affecting Battery EVs sale in the UK

- Understanding Electric Vehicle Taxation in the UK

- 2024 Changes to Electric Vehicle Taxation

- What Future Withholds for Battery Electric Vehicles?

- Maximising Electric Vehicle Tax Benefits

- Highly Developed EVs charging ecosystem

- Preparing for the Future: Electric Vehicles and Taxation in the UK

Factors Affecting Battery EVs sale in the UK

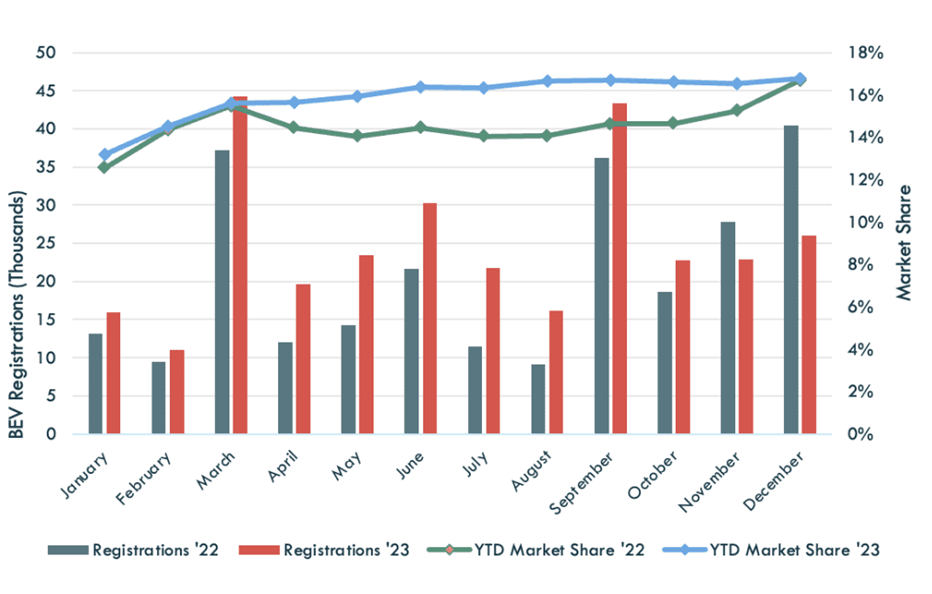

To reduce UK greenhouse gas emissions, EV sales have significantly increased from 3,500 in 2013 to over 350,000 in 2022. During 2023, the electric car market share witnessed steady growth, with 1 in every 6 cars sold being a Battery Electric Vehicle (BEV).

Numerous factors contribute to the fast-growing trend of buying EVs in the UK, including:

- The urgent need to address climate change

- The UK government’s efforts to encourage cleaner transportation

- Choosing electric vehicles for transportation has over £2 billion as the UK government investment backing. This supports economic growth, creating thousands of highly skilled job opportunities.

- A proposed complete ban on new internal combustion engine (ICE) vehicles sale by 2035

Monthly UK battery electric vehicles registrations during 2022-2023

The UK encourages electric vehicle utilisation and caters to ecological concerns through this initiative.

Understanding electric vehicle taxation in the UK

The EV market has experienced significant growth in the United Kingdom, propelled by the government’s financial incentives.

- VED

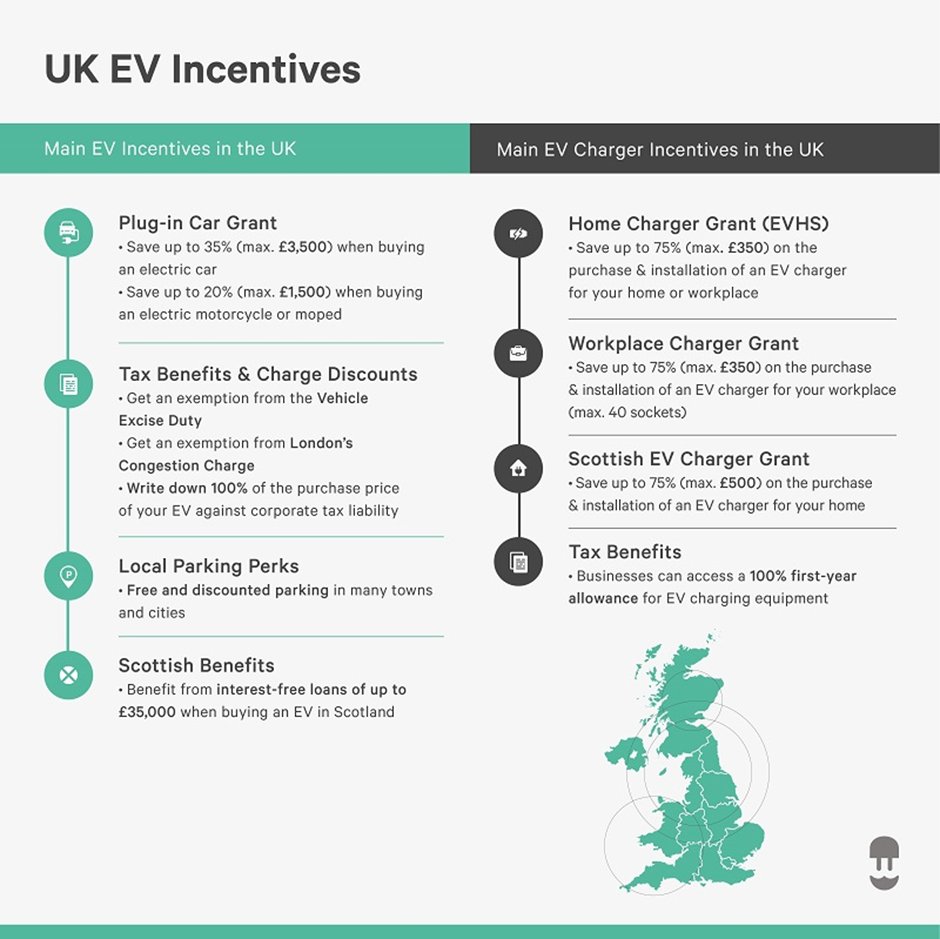

A vital step of this support is the exemption from Vehicle Excise duty (VED), usually known as road tax. It holds good for EVs meeting specific electricity sourcing criteria.

This exemption has enhanced EV appeal for potential purchasers. Simultaneously, it aligns with the government’s overlying objective of encouraging environmentally friendly transportation.

Interestingly, it is vital to note that hybrids do not profit from a complete VED exception. These are instead subject to rates based on their CO2 emissions.

- BIK Tax Incentive

EVs enjoy a reduced Benefit-in-Kind (BIK) or company car tax, mainly when utilised for personal purposes. Notably, the BIK benefit for EVs will increase in the coming years. Hence, there is potential for additional tax advantages for EV drivers.

EVs registered between March 2001 and March 2017, boasting low CO2 emissions, also qualify for road tax exemption. This further incentivises the transition to cleaner vehicles.

- Congestion Tax

Electric cars (EC) are also exempt from congestion charges in the UK until 2025. Congestion charges are payments levied on vehicles entering a Clean-Air Zone (CAZ), including London, Birmingham, and Oxford places.

Company ECs can avail of Congestion tax exemption under the electric vehicle tax relief scheme if these travel within central London and other city centres.

These electric vehicle tax relief incentives with a few more reflect the UK government’s resolute obligation to encourage supportable and eco-accommodating transportation options. These resolutions promote the widespread adoption of electric cars and decrease the country’s carbon footprint. Additionally, these drive financial benefits for customers and businesses.

2024 Changes to Electric Vehicle Taxation

The UK government has removed the Electric Vehicle Tax. It will be replaced with Vehicle Excise Duty (VED) starting in April 2024.

The Plug-in Car Grant initiative provides incentives of up to £2,500 for eligible new EVs.

This move is the government’s dedication toward tax equity and tackling environmental issues by increasing the number of electric vehicles nationwide.

The upcoming VED reforms will impact current and potential EV owners. Thus, it is essential to carefully consider the evolving costs and financial commitments involved in the transition to EVs.

Other changes to the UK government’s tax structure include:

- Preservation of ISA limits

- Elimination of the Dividend Allowance.

- Combination of the SME and Research and Development Expenditure Credit (RDEC) schemes

Current and potential EV owners should navigate the evolving environment of vehicle taxes and sustainability measures.

What future withholds for battery electric vehicles?

The specific VED rates for EVs will be announced closer to the implementation date. However, the changes are expected to apply to new and existing EVs.

Zero-emission cars first registered on or after April 1, 2017, will be liable to pay the lowest first-year rate of VED, which currently applies to vehicles with CO2 emissions of 1 to 50 g/km.

The UK government’s zero-emission vehicle (ZEV) initiative mandates opting for electric vehicles. By 2030, it requires 80% of new cars and 70% of new vans sold in Great Britain to have zero emissions. Furthermore, this will reach 100% by 2035.

The 2035 end-of-sale date will align the UK with other major global economies. Other countries that follow a zero-emission vehicle framework include names like France, Germany, Sweden, and Canada.

These changes highlight the UK government’s commitment to promoting fairness in the electric vehicle tax benefits and addressing environmental concerns.

Maximising electric vehicle tax benefits

To maximise the financial benefits of electric vehicle (EV) ownership in the UK, try utilising current electric vehicle tax credits and exemptions. This can minimise the impact of the new VED rates.

Before the tax rate changes, benefit from the government’s Plug-In Car Grant. It provides a discount on purchasing eligible electric vehicles.

Additionally, EV owners are exempt from paying the London Congestion Charge (until 2025) and Ultra Low Emission Zone (ULEZ) fees. This means now is the best time to switch to electric vehicles and make the most of these electric vehicle tax benefits.

Highly Developed EVs charging ecosystem

UK Residents should consider installing a home charging point to optimise their financial advantages. The installation can claim the benefit from the Electric Vehicle Homecharge Scheme. This grant will cover part of the installation costs.

Moreover, using public charging networks. Take advantage of off-peak electricity tariffs to reduce the EV ownership cost.

Before the new VED rates apply, EV owners should try to maximise their vehicle’s efficiency. This will minimise tax implications.

This can be achieved through:

- Regular maintenance

- Efficient driving practices

- Staying informed about future government incentives or policy changes

Preparing for the future: Electric vehicles and taxation in the UK

Understanding and planning for the impending electric vehicle (EV) taxation changes in the UK is vital. It will help you boost financial benefits and explore the advancing administrative scene.

The Office for Budget Responsibility (OBR) report depicts the significant effect of tax collection on EV ownership, underscoring the need for proactive measures.

The UK government has introduced VED for electric vehicles. To minimise upfront expenses, people should explore electric vehicle tax credit, such as zero VED rates.

Additionally, staying informed about changes in taxation policies and analysing strategies can mitigate the impact of new tax rates.