The First Homes scheme is a government project to provide affordable housing units to the locals. A first time home buyer with a low budget or a key worker must know the scheme in detail.

Credit: really moving.com

Individuals may find it challenging to step foot on the property ladder due to insufficient funds. Moreover, the cost of living in various parts of the UK is higher. It makes saving difficult for individuals to fulfil the dream of owning a home.

The government is aware of the difficulties mentioned earlier and came up with the first home scheme. Property prices have kept rising for the last few years, but thanks to the UK government for lending help to the financially weaker class with their home schemes.

Contents

What is the first home scheme?

How does the first home scheme work?

What are the eligibility criteria for a first home scheme?

What is the impact of the scheme on the market?

What are the alternative government schemes?

Wrap up

What is the first home scheme?

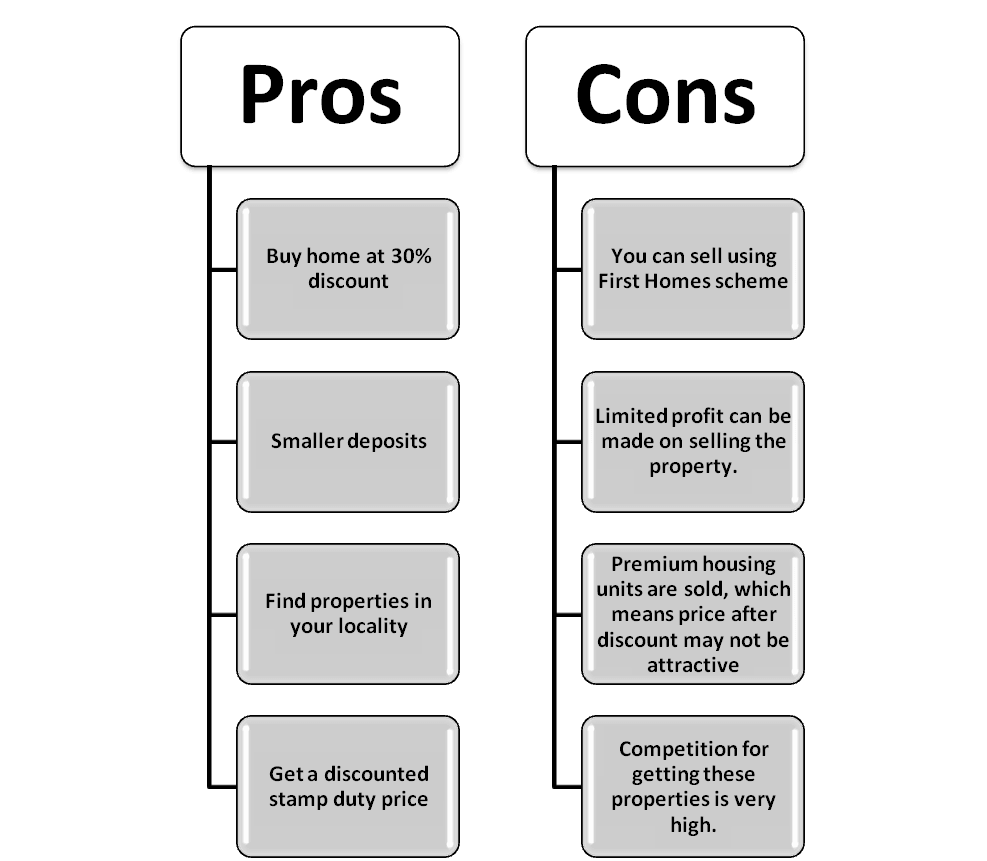

According to the government’s first homes scheme, individuals, couples, or groups can purchase their first home at a 30% discounted market price. Local councils can allocate discounts further up to 40% and 50% in parts of the UK with the higher cost of living.

Key points of the first home scheme:

● The new policy targets to offer affordable housing units to buyers who meet the first homes eligibility criteria

● The buyer must be a local to purchase a property in that community

● The priority buyers are the serving members and veterans of the Army and key workers like nurses, teachers, and police.

● The discount rate will be passed on to the future buyers of that property and continue helping people climb the property ladder.

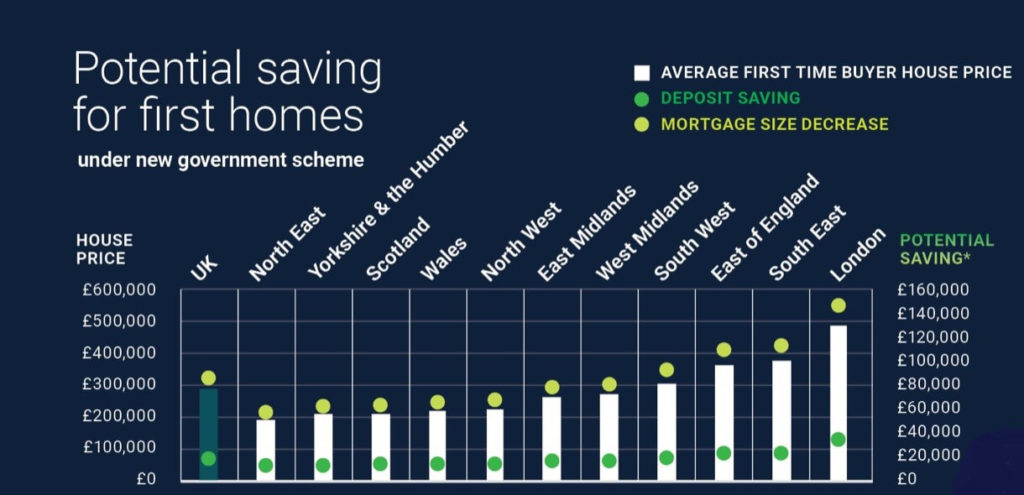

Credit: Dataloft inform

How does the first home scheme work?

In June 2021, the government introduced the first home scheme and planned to construct 1,500 first homes for the next two years in 100+ locations.

A minimum 30% discount on the first homes is an excellent opportunity for first time home buyers. The first selling price, excluding the 30% discount, cannot be more than £250,000 in the UK and £420,000 in Greater London. It applies only to first-time buyers.

For example, the market value of a property is £500,000. An eligible first-time buyer can purchase it for £3,50,000 after excluding a 30% discount. So, they can save £1,50,000.

Additionally, the local area councils have the right to set a more significant discount for locals. It can be up to a 50% discount to ensure the property is cheaper and more affordable for first-time buyers.

Individuals can purchase these affordable housing units in the usual way and access conventional mortgage products.

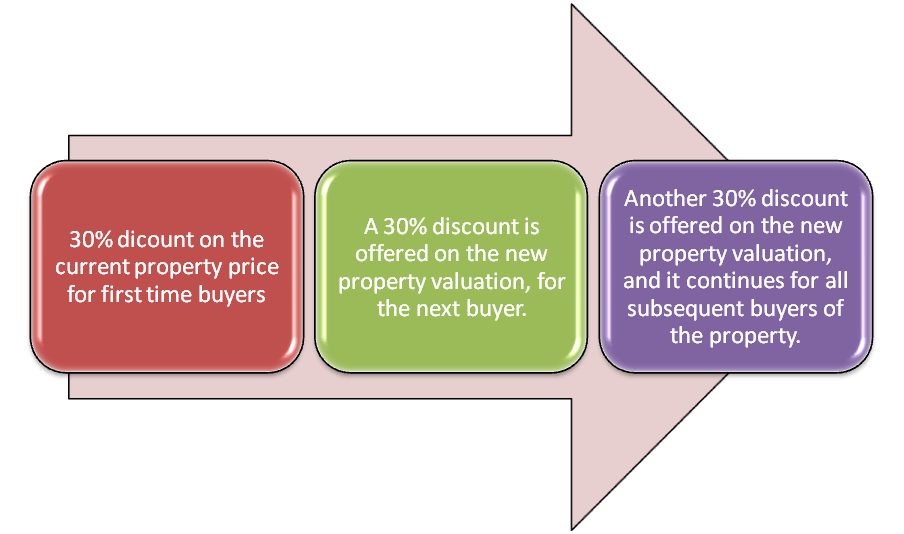

The owner may sell the house to move a step higher up the property ladder. After doing the independent property valuation, a 30% discount is applicable on the selling price. It continues for all subsequent buyers, and discounts are applicable on the property’s new value.

Let us take an example to understand the above diagram,

● The property has a price of £200,000, and after deducting 30%, it becomes £140,000.

● But, after five years, when you want to sell the property, its valuation has risen to £250,000.

● Apply a 30% discount; the price becomes £175,000 for the next buyer.

● Again, the property’s current market price after another five years is £300,000.

● Please deduct 30%, and it becomes £210,000 for the next buyer.

● It continues for all the subsequent buyers without failure.

These housing units cannot serve as holiday homes. Individuals can purchase their first homes only when they want to live in them.

What are the eligibility criteria for a first home scheme?

There are some eligibility criteria for availing of first home schemes. We will discuss them next.

● An individual, couple, or group of individuals must be a first time home buyer.

● Buyers must choose a property in their locality. That means where they stay and work. Additionally, the first homes cannot serve like holiday homes, and they must be your housing unit.

● Neither should they have an annual household income above £80,000 in the UK except for London (£90,000). Also, they don’t have any property beforehand.

● After the discount, the purchaser should have a mortgage product or a home purchase plan to fund at least 50% of the purchase price.

● A local connection can help lower-income caps get additional discounts. These authorities verify the application against some vital criteria and decide whether to provide other discounts.

● All professionals can apply for first home schemes, but the priority buyers are key workers who provide emergency or essential services like nurses, army men, teachers, doctors, police, etc.

What is the impact of the scheme on the market?

The government has observed how homeownership is getting out of reach for several households in the UK. The first home scheme is a product that solves the issue.

But, it has created tension among the home developers to meet the increasing housing demand. The disbalance in the demand-supply chain will increase the price of housing units in the long run.

This scheme may reduce the availability of rental houses, thus impacting the traditional and other affordable housing products. Additionally, shared ownership products will have a double blow in the upcoming years.

What are the alternative government schemes?

There are several alternatives to the government’s first homes scheme.

Shared ownership

You can purchase a share of the housing property and pay rent for the remaining share. The rent charged is comparatively lower than the market price. You get the chance to purchase additional shares of the property.

Help to Buy: Equity loans

Equity loans under the scheme cover up to 20% of the buyer’s first home deposit amount. Buyers need to pay a 5% deposit and secure a 75% mortgage on the remaining part of the purchase price.

Lifetime ISAs

You can buy your first home by withdrawing from the Lifetime ISA (Individual Savings Account). An individual can save £4,000 each year in ISA until he reaches 50, and the government allocates a 25% bonus on your savings. That can be up to £1,000 per annum.

100% mortgages

You don’t need to make any deposit here, but a family member or a friend must be your guarantor mortgage. If you cannot meet your payments, they will be liable to pay it.

Wrap up

The First Homes scheme is an excellent opportunity for first-time buyers to fulfil their dream of owning a home. You can contact a builder to know the first homes in your locality.

These professionals will check your applications and verify eligibility for the scheme. The applications are handed over to the local authority to reserve a plot and pay a fee. You need to apply for at least a 50% mortgage before making a purchase.

If you want to purchase your first home but cannot meet the rising property price, start preparing for the first homes schemes. There will be several opportunities soon available in the market, and you cannot miss them out.

Leave a Reply