Do you want to purchase a home but cannot afford it? Under the shared ownership scheme, individuals can buy a part of the property and pay rent for the remaining portion.

However, a question arises, is it safe to choose a shared ownership scheme? Here is a guide for understanding the shared ownership pros and cons. The blog post allows individuals to set out the first foot on the property ladder, but certain pitfalls are associated.

Credit: YM Liverpool

Table of contents :

● What is shared ownership?

● What kind of homes can I purchase through shared ownership?

● Who can apply for a shared ownership scheme?

● How do shared ownership schemes worked?

● Wrapping up

What is shared ownership?

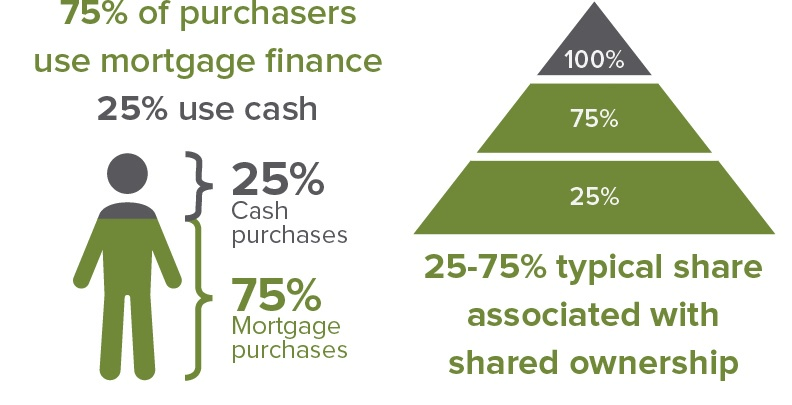

Different housing associations in the UK offer shared ownership schemes to first time home buyers. It is a housing scheme designed for the locals to purchase a part of the property, generally 25% to 75% at the market value, and rent the remaining portion. One can also buy a 10% share of some housing units.

Now homebuyers don’t need a bigger mortgage to buy a housing unit. Take out a mortgage of your capacity to buy the share or use your savings. A deposit of 5% to 10% will secure your share purchase.

Under the scheme, you can even increase your shares, known as “staircasing”. When you buy more significant shares, you pay less rent, and the rent depends on the landowner’s demand.

Credit: Optimal Solicitors

What kind of homes can I purchase through shared ownership?

Under the scheme, you can purchase a newly built housing unit. Other options are:

● Buying an old house through the resale scheme of shared ownership.

● Purchase a particular home that meets your requirement if you suffer from a long term disability.

All the houses and flats under the shared ownership scheme are leasehold properties.

Who can apply for a shared ownership scheme?

There are specific eligibility criteria for applying to the scheme. These are,

● The applicant’s annual household income is not more than £80,000 except for London, £90,000.

● They cannot afford the higher deposits and mortgage payments that meet their housing unit needs.

● They must be a first time home buyer.

● They may have had a home previously but cannot afford a new home.

● They are setting up a new household.

● They’re an existing shared owner and want to relocate or purchase a new property under the scheme.

● They have a home but want to relocate for some reason but cannot meet the high property prices.

● Some homes under the scheme provide living units only to locals who stay and work in the same locality.

● Individuals above 55 years can buy 75% share through OPSO or older people’s shared ownership scheme. If they purchase a 75% share, they don’t need to pay rent on the remaining portion.

● Disabled people can also apply for purchasing new housing units using HOLD or homeownership for people with a long term disability.

● Key Workers, especially the armed forces, are among the high-priority groups that can apply for housing units under the scheme.

How do shared ownership schemes work?

Under the shared ownership scheme, you buy a share of the housing property with little mortgage and deposits and pay rent to the landowner for the remaining portion. Its working is:

● Purchase 10% to 75% of the housing property. Generally, it is 25% to 75%, but some provide you with an opportunity to buy a share of 10%.

● Pay rent for the remainder to the landowner.

● Pay a monthly ground rent and service charge.

● Increase the property shares in the future.

Let us take an example to understand its working,

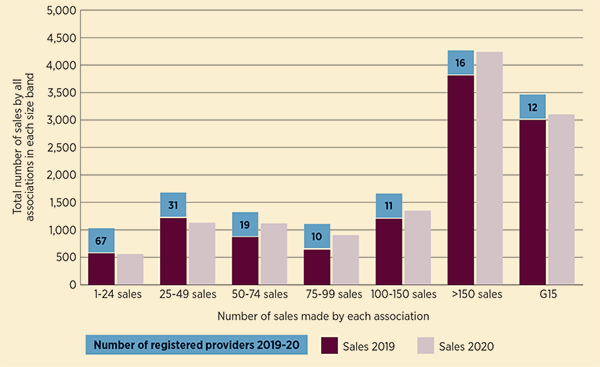

Here is a graph to represent sales of the housing units in 2019 and 2020,

Credit: Social Housing

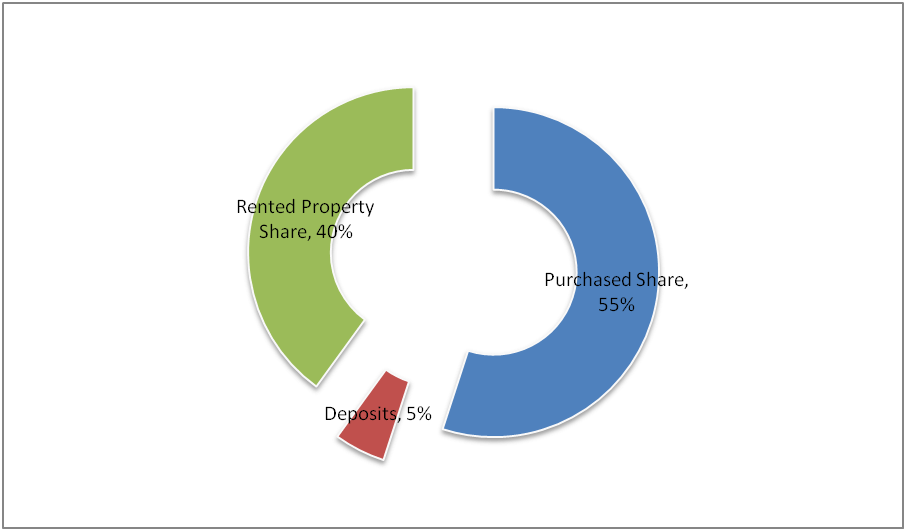

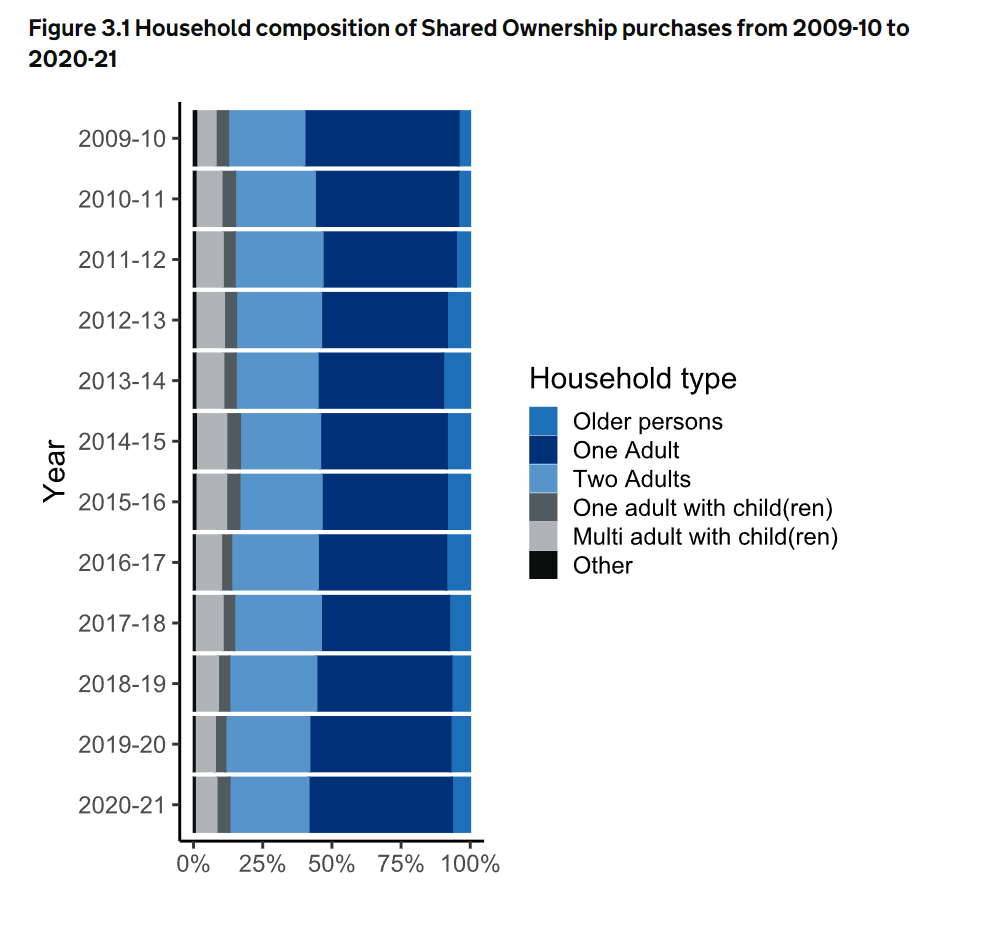

Here is a historical household composition of home purchases under the Shared ownership scheme between 2009 to 2021.

Advantages of shared ownership

1. Easy to get on the property ladder

The primary advantage of shared ownership is its easy achievability than full ownership, as you need a smaller mortgage. You can get on the property ladder without overstretching your capabilities.

2. Lower deposits

Though the repayment of the mortgage and the rent payment can be more significant than the repayment on full mortgages, smaller deposits can help you achieve your dreams.

3. Increase shares in future

You may start with a 25-75% share of a property, increase the share slowly, and eventually own the property. It is known as “staircasing”.

An individual can buy up to 10% or more of the house share under new formats. The older leases can allow you to purchase up to 25% or more home property shares.

4. Security

You can live in the property as long as you clear the rents and mortgage payments. The duration of your stay is equivalent to the lease duration, which can usually be 99 to 125 years.

5. Sell or rent

Though you cannot sublet the entire property under the scheme, you can rent a room in the home. However, you should stay in the house permanently.

If you are a 100% shareholder or have permission from the landlord, you can sublet the property.

Disadvantages of shared ownership

1. Hidden costs

Different housing associations have some hidden charges that you must ask about initially. For example, however small your share is, you must pay the 100% ground rent and service charge. Others can be solicitors’ fees, management fees, repairs reserve fund payments, etc.

Also, the rents are different for each housing association.

2. Pay your stamp duty

Unlike the first homes scheme, the stamp duty is not free here in most cases. Individuals need to pay stamp duty on the whole property worth if their share is equal to 80% or more.

3. Selling is complicated

As you pay rent for a portion of the property, you are a tenant. It includes several restrictions on your activities, like selling or renting the whole property.

You can sublet 1-2 rooms from your portion only when you stay in the property permanently. To rent the entire property, either you need to purchase 100% share or ask permission from your landlord.

4. It is a long term commitment

Under a shared ownership scheme, providers sell houses on a leasehold basis. You have the right to use the house for 99 to 125 years.

Purchasing a housing property is costly, making an individual stay for several years for financial benefits. However, if the cost of housing properties falls, your equity prices will also negatively impact you, and you will lose money during relocation.

5. Mortgages

Not necessarily the owners will provide a mortgage for the home buyers. However, most owners offer mortgages to make purchasing property under the scheme easy to achieve.

6. Home renovation requires approval

You are not the entire property owner and have a landowner, so you cannot renovate the house singly. If the house providers and landlord permit your request for home renovation, you can proceed with the process. However, you can make changes to the interior decoration.

Wrapping up

Owning a house is a dream of every individual. But, income restricts them from fulfilling the dream. Therefore, the government came up with several schemes for first home buyers and shared ownership is one such type of scheme.

If you want to purchase a part of the property, ask a professional to make you understand. You can take help from financial advisors to stay away from legal complications and enjoy other benefits under the scheme.

Leave a Reply