Accountancy has always been considered to be one of the most dynamic, exciting and secure career options.

Accounting statistics reveal that more than 90% of businesses admit that they don’t know enough about finances and accounting. Though with the rise of the digital era, spreadsheets have become obsolete, but that doesn’t mean accountants have also.

Accountants have a vital role in all three aspects of finance- private, business and public finance.

As an accountant, whether you work in a multinational organisation or for sole traders, your service will significantly impact their success.

There are different routes and qualifications you can explore if you choose the journey of becoming an accountant.

To give you a hint of this journey here, we have gathered some information about becoming an accountant.

This blog post is divided into the following sections

Table of Content

What is Accounting?

So let’s start with the term itself; well, accounting is the process of producing financial information of a business or an individual.

This process includes recording, classifying, and reporting transactions.

To do these, accountants need to gain technical skills, understand financial know-how, and learn to interpret financial data with an in-depth understanding of business and finance.

So don’t imagine an accountant as a serious suit-wearing, pen-wielding number cruncher! Because accountants are intelligent and interesting people passionate about making your wealth grow and work for you.

Types of accountants and What do accountants do?

An accountant helps you see the financial picture of the business by preparing a business’s accounts.

In preparing accounts, accountants play a significant role in turning the wheel of a business forward by tracking its financial transactions, any risks or irregularities, and so on.

Specific types and responsibilities of an accountant vary though the role of an accountant is as below,

1. Chartered/ Certified accountant

Chartered or Certified accountants are upper-level accountants who are considered as an expert in the field. While they may do traditional compliance roles like tax filings and accounts perpetration, their primary function is to act as a trusted advisor advising on all aspects of the finance.

Such accountants can engage in public practise or employed by an organisation. You will find experienced chartered or certified accountants as CFO, finance director, CEO, or some other senior-level positions in an organisation.

Check out our guide on: the difference between an accountant and a bookkeeper.

2. Auditor

Most auditors are also qualified, chartered accountants or certified accountants. As part of the accounting qualification, they choose to specialise in an audit.

Usually, this involves rigorous audit training for three years. Even auditors tend to specialise in various types of audits, like industry-specific- banking, asset management, insurance, retail, pharmaceutical, government, etc.

The audit has many types, like external, internal, forensic and so on.

3. Tax accountant

Like an audit, Chartered or certified accountants can also specialise in tax. The route is similar, first passing specialised tax exams and then working experience.

Like auditors, tax accountants have many industries and sector-based specialisation like direct taxes, indirect taxes, international taxes etc.

There are also specialist tax qualifications, like CTA.

Check out our article for the: difference between a tax advisor and an accountant.

4. Management Accountant

Another branch of accounting, concerned with translating raw financial data into useful information for managers, directors, owners and key decision-makers within an organisation.

Management accountants typical roles involve planning, decision making, organising, controlling, analysis, communication and coordination of financial and non-financial information in an organisation.

5. Forensic accountant

It is another branch of accounting concerned with applying accountancy knowledge in the circumstances having legal consequences.

For example, fraud, economic damage calculations, compliance with anti-money laundering, liquidations and bankruptcies, derivatives and securities fraud, misappropriation of assets, and the list goes on.

Skills required to become an Accountant

It’s the cherry on the cake if you are good with numbers because accounting is not only about reporting financial data, but it plays a huge role in shaping the future of an organisation.

Let’s have a look at some of the key skills,

Numerical skills

It’s a fact that now we do not need a pen-paper to record and calculate transactions, yet there’s no getting away from it.

Being a master of mathematics is obviously not the point here.

Accountants work at various levels in organisations, right from a junior level to as CEO and finance ministers. Each requires a different level of numeracy skill levels. However, one thing common among all these is the ability to map the dots, see underlying relationships between numbers and build a bigger picture.

Communication skills

You’ll find not a single carrier option where communication skills are not essential, except being a sole caretaker of a desert island.

A recent survey conducted by Bloomberg from 20 CEO’s of the Fortune 500 companies shows that companies value analytical and communication skills far more than technical skills.

Time management

The ability to work within your deadlines and to continually re-prioritise your task can take you far in your accounting journey.

Because you will need to manage competing priorities and juggle myriad tasks while competing for every single thing on time.

That’s why it is important for an accountant to know how to budge the time.

Organisation

Accountants manage a huge responsibility, which means they stay pretty busy.

That’s why you need to have a system to keep track of responsibilities such as any transactions you handle, any important dates or deadlines you need to meet.

So that you can make sure you fulfil all of your duties to the best of your ability.

Commercial awareness

Maybe it is a bit surprising that people generally forget about this.

The need for commercial awareness is crucial, whilst several skills are an offshoot of common sense.

Commercial awareness is the understanding of how and where the particular business fits in the market, how it is affected by a social and political movement, changes in the economy and how it can forge ahead and evolve.

It is all about knowing your craft.

Credibility/integrity

We all use particular brands that we are fond of using, and mostly, ‘Trust’ is the reason behind our choices.

The same applies when you are building a career; you want people to put trust in you and your work.

Here, credibility is the currency you can trade on; more credibility brings more opportunity.

By building a credible brand, you are laying the foundation for a solid future. The question is, how to build credibility in an organisation? Here are our top 10 tips:

- Accept mistakes

- Be competent

- Be genuine

- Be honest

- Be loyal

- Be patient

- Be persistent

- Be principled

- Be sincere

- Be trustworthy

- My word is my bond

- Show empathy

The different Accounting qualifications

There are different qualifications you can go with to become an accountant.

| Qualification | Description |

| Institute of Chartered Accountants in England and Wales (ICAEW) | This qualification recognised as one of the most professional business development program available globally. This requires aspiring accountants to complete at least three years of on-the-job training while passing a series of exams. |

| Associate Chartered Certified Accountant (ACCA) | It can be taken either independently or as part of a training agreement. Open up many career options like working within private or public sectors, accountancy firms or becoming self-employed. Qualification can be complete as part of a bachelor’s or master’s degree. |

| Chartered Institute of Management Accountant (CIMA) | You will need a CIMA qualification if you want to break into management accountancy. CIMA will give a deep knowledge of management accounting with its range of levels which contains three broad areas – Operational, management and strategic. This qualification ensures you are all set for expert management and strategic roles such as financial analyst and financial director. |

| Institute of Chartered Accountants of Scotland (ICAS) | It usually takes 3 years to qualify as an accountant from ICAS. This involves work experience and passing exams. |

| Institute of Financial Accountants (IFA) | Multiple entry routes are available to become an accountant, like experience or passing exams. |

Focus on a specialism

By choosing a specific area, you can make yourself out of the competition and add value to your knowledge to match the real-world work.

Check out our guide on: 19 Ways an Accountant Can Help a Small Business Owner

The accounting field will divide further areas into Management accounting and financial accounting.

You will explore further specialist fields within these divisions, including financial analysis, budget analysis etc.

As compared to Management accounting, financial accounting is required by law and provides a variety of career prospects including,

- Corporate finance

- Tax

- Audit

- Business recovery & insolvency

- Forensic accounting

So, you can go for specific accounting studies like forensic accounting, management accounting, auditing etc., or you can focus on some industry-specific expertise.

So, how much a newly qualified Accountant earn?

Well, the salary of an accountant depends on various factors, including the qualification and size or type of the firm.

Salaries in the UK vary from city to city and industry to industry. For example, London salaries usually tend to be higher than the rest of the country.

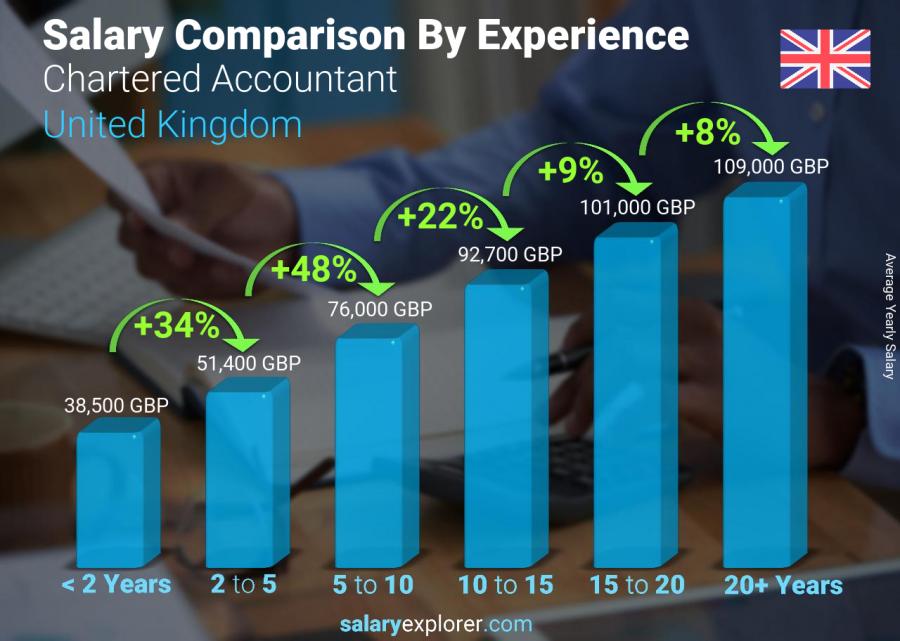

According to Salary Explorer, a newly qualified accountant can expect a salary above £30,000, and with two to four years of experience after qualification, an accountant’s salary could go over £50,000.

More experienced professionals, a specialist in a niche like banking, can expect salaries over £100,000 after 8-10 years of post-qualification experience.

Let’s sum it up

As we have seen above, there is a wide range of qualifications which enables you to become a specialist number cruncher in the UK.

Plus, if you fancy working abroad, you are in luck because UK qualifications are accepted globally.

From helping individuals and companies file taxes for detecting financial crimes, being an accountant means having a fascinating career.

Leave a Reply