Setting up a correct payroll enhances your ability to stay on top of your legal and regulatory duties as an employer. It saves time and costly HMRC fines.

If you’re instituting a business and hiring workers, ensure a payroll manager takes care of the payroll systems. If you get it wrong, you might end with disgruntled staff and HMRC fines.

There’s a lot more to it than just compensating employees. As a result, we’ve put together this guide to assist you in getting it right and staying in line with HMRC’s expectations.

Whether you plan to run your firm’s payroll internally or outsource it to payroll companies, you must understand payroll basics.

To know more about outsourcing payroll services, read our blog payroll.

Table of Content

What is payroll?

Payroll is the process of calculating, paying, and recording employee wages and related costs. It is one of the essential business processes and has a significant impact on employee morale.

The payroll process includes:

- Calculating individual employee’s wages and paying them

- Managing bonuses and other benefits

- Paying employees tax and National Insurance (NI)

- Submitting Payroll details to the HMRC

- Filing pension to the pension scheme

- Maintaining financial records

Payroll complies with employment law

An employer must set up a PAYE scheme with HMRC, check the employee’s work permit and right to work in the UK, calculate taxable salary, deduct taxes, pay employees and submit the payments to HMRC.

Failing to do so can lead to being fined by HMRC.

Be clear on the laws of employment that include pensions, auto-enrolment, overtime pay, holiday pay, maternity, and paternity leave.

How does payroll work in the UK?

In the United Kingdom, payroll works through the PAYE (Pay as You Earn) system. As an employer, you must determine how much tax your employees owe, deduct it from their pay and submit it with HMRC.

You repeat the process whenever you pay your employees.

Critical timelines to send recent pay deductions to HMRC

To know more about Payroll UK year-end 2021, read our blog on what is payroll.

Setting up your business payroll

Payroll can be time-consuming and confusing if you don’t know where to start and what to do.

According to a survey conducted by Censuswide, 75% of Big UK Companies have admitted that they have paid employees late or incorrectly in the 2020-21 tax year. This is because of the flawed payroll system followed in the companies.

Paying your employees correctly and on time keeps their morale high, which boosts the performance and output.

1. Register as an employer

Once you have decided to hire an employee, the first step is to register as an employer with HMRC before the first payday. You can do this on the Gov.UK website.

Once you have registered, you will get an employer reference number and Accounts Office Reference number. Use these to set up an online account on the HMRC website. You will need the login credentials to submit reports to HMRC.

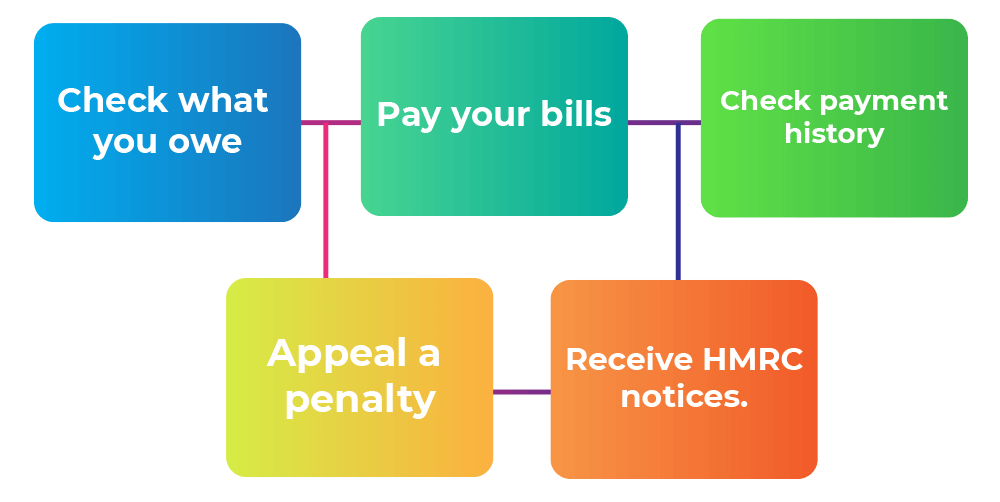

As an employer, PAY online services are used to:

What notices do you receive from the HMRC?

Usually, you will receive the below notices from HMRC through PAYE Online.

- Tax code notices like P6 and P9. P6 provides an employee’s tax code and previous pay and tax, while P9 is given by HMRC to employers when an employee’s tax code is changed.

- Student loan notices like SL1 or the start notice that notifies the correct loan type and SL2 or the stop notice instructs an employee to stop deduction amount for the loan taken.

- NI verification notices like NVR and NOT

- Alerts on late reporting and late payment

2. Choosing the best payroll software

While setting up a payroll in your business, choose the right payroll software that is efficient enough to record the employee’s details and calculate pay and salary deductions.

Payroll software saves time and reduces errors. It assists you in:

- Recording the employee’s details

- Calculating statutory pay like sick pay or maternity

- Computing How much you owe HMRC

- Calculating employees’ income and deductions

- Reporting payroll information to HMRC

- Generate pay slips, P45, P60

- Employee login to access Pay slips securely and other reports

- Prepare and push journals to your accounting software

- Prepare and push pension data to your pension provider

To know more about payroll software, read our blog on payroll software.

3. Maintain payroll records

You must collect and keep records of

- How much you pay your employee’s and the deductions you make

- Reports you prepare to submit to HMRC

- Payments you make to HMRC

- Employee sick leave and other absences

- Tax code and notices

- Taxable expenses and benefits

- Payroll giving scheme documents

Tip

How long should I maintain payroll records?

You must keep employee’s training, employment history, and terms and conditions of records for the current tax year plus the previous 3 years. In practice, many employers keep these records for 6 years.

4. Get adequate information about your new employee

As an employer, you must inform HMRC when you have hired a new employee.

You must check if you need to pay your employees through PAYE.

You can pay an employee through PAYE if they earn £120 or more a week, which means £520 a month or £6,240 a year.

You need not pay the self-employed workers or contractors through PAYE unless they fall under IRS35 regulations.

You need to get information and details from the employee that include:

- Date of birth

- gender

- Full address

- Start date

You will also need to get the below-mentioned information from your employee’s P45.

- Last date of their previous employment

- Gross pay and taxes paid for the current tax year

- Student loan deductions

- NI number

- Existing tax code

You can register your newly hired employee with HMRC by including their details obtained on an FPS (Full Payment Submission) the first time you pay.

Make sure to include the below in the FPS

- Collected employee information

- Tax code and starter declaration

- Pay and deductions

5. Remember pension contributions

Every employer in the UK must offer a workplace pension – a legal obligation.

Ensure that you add this to your payment so that the employee contributions and your calculations are accurate.

6. Sending payroll reports

Businesses are required to report HMRC employee payroll information, regardless of the amount of income tax owed.

You can do this by sending FPS from your payroll software.

7. Delayed reporting

Reporting late is unacceptable.

HMRC will give you a late filing warning if you have paid workers but haven’t filed an FPS or have sent one late.

Unless you have a good cause for being late, HMRC may impose a penalty.

Penalties range from £100 per month for businesses with 1 to 9 employees to £400 per month for companies with 250 or more employee’s.

8. Making a payment on what you owe

The employer must pay National Insurance through their PAYE bill. The employee’s salary will determine the amount you pay.

To calculate employer National Insurance Contributions (NICs), use our calculator.

What happens when you don’t run payroll correctly?

Around 200 companies, including Pret, McColls, and Welcome Break, were named and shamed by the HMRC for not paying minimum wages to their employees.

Between 2011 and 2018, investigations were held on 191 firms because they failed to pay £2.1 million to over 34,000 workers. The firms were ordered to repay the funds and were fined £3.2 million.

According to Pret, McColls, and Welcome Break, the underpayments were historical mistakes, and they paid the employees immediately.

Nearly half of the violations made by companies deducting pay from wages were for uniforms and expenses.

Remember, if you don’t practice proper payroll management, you will pay a hefty sum of penalties.

Wrapping up

Getting your first employees on payroll is a significant step for any small business. This achievement signifies that your company is one step closer to being self-sufficient.

Instead of focusing on performing all of the work oneself, employees help small company owners focus on the things that develop the firm.

A small business payroll system should accomplish the same thing—take the manual work off the entrepreneur’s hands to continue developing and expanding their company.

Follow the guidelines given above to guarantee you’re fully compliant and have a solid system to prevent mistakes. An accountant may help you or handle your payroll for you, ensuring that it is in excellent hands and that records are filed correctly and on time.

Leave a Reply