Open banking is already changing the traditional banking sector along with payments and lending, but what does open banking mean for other industries like accounting?

Open banking has a lot of advantages to accounting firms as it offers several chances to automate manual processes and improve financial transparency in a business so that the accountants can focus on challenging decision-making tasks.

Here are three easy ways that accountancy services may use open banking to boost sales – whether through automation, cost savings, or simply by attracting more clients with a better experience.

In the blog, we shall check out what is open banking and its benefits for accounting firm UK.

Credit: cashdash

Table of Content

What is open banking?

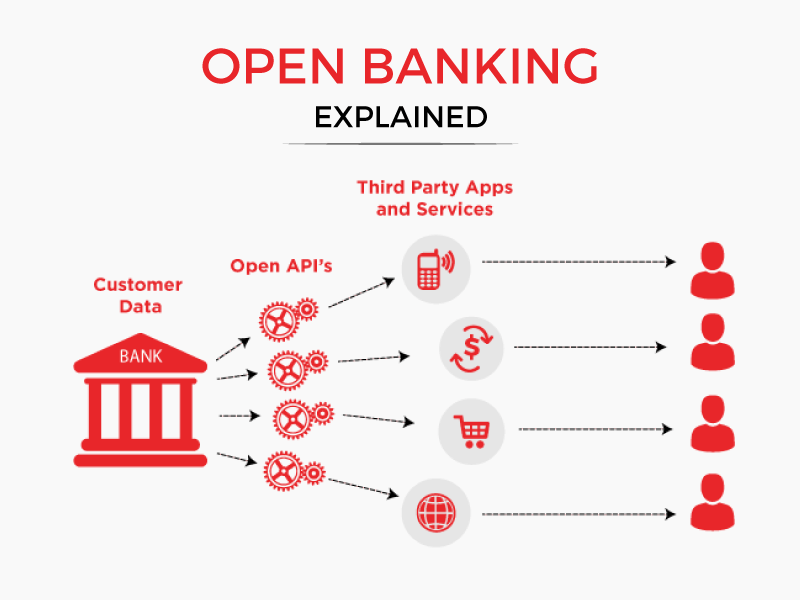

Open banking is the sharing of financial data and services with third parties through the use of APIs.

Third parties typically offer technology, an app or a service to the bank’s clients using the shared financial services and data.

For instance, the statements and transaction records of the bank’s clients are included in the shared financial data.

This information cannot be made publicly accessible; instead, it is only shared upon the consumer’s explicit request.

Open banking enables the legal frameworks and technological infrastructure to make such consent-driven sharing possible.

As a result, users can utilise apps to understand better their financial behaviour, such as spending and cash flow, enabling them to obtain financial services that are more relevant and affordable.

Traditional banks compete fiercely with smaller, more agile financial institutions and challenger banks, while consumers benefit from better options.

What are the benefits of open banking?

All financial services companies can benefit from open banking APIs since they help them increase customer engagement and attract new clients by meeting their changing needs in accessing their financial information.

Additionally, it creates new digital revenue channels that emphasise banking APIs.

Besides the banks, regulators, and startups, you may already be using third-party financial management products that open banking will enhance.

Consumers will have more options for managing their finances, borrowing money, and making payments.

As a customer, you can link your bank account with a website or an app that records your purchasing behaviour and recommends new products like credit cards, investment opportunities, or savings accounts.

Following are some of the benefits of open banking:

- Businesses can take advantage of new technologies to reduce costs.

- New product launches are completed more quickly.

- Helping people save, borrow, lend, transact, and invest their money.

- Possibility of a new business channel with more product offerings.

Open banking’s impact on the market

Open banking benefits small firms over the market leaders since it opens up new channels for potential opportunities.

New enterprises can now enter the market with smaller, more economical alternatives to traditional banking services.

Larger, more established banks will have to put in a lot of effort to avoid being affected by the entry of new competitors.

This aims to save expenses while promoting modern technology and better customer support.

Open banking can enable all institutions to develop relationships with their consumers rather than just handling financial transactions.

The impact of open banking on accounting firms

Accounting professionals must learn how to use open banking tools to their advantage to stay ahead of traditional companies.

Open banking offers a seamless method for acquiring financial information and more chances for automation for both clients and accountants.

1. An evolving role

Accounting professionals may have concerns about open banking applications since they give users better, more reliable ways to manage their finances.

Clients will require assistance and knowledge to choose wisely from the wide range of financial products and services available.

That’s where accountants can help. Open banking is another chance for accountants to put their skills to use and modernise their services for a future-proofed business rather than fighting the new wave of financial management.

Accountants have the opportunity to take on the position of a trusted advisor and make the most of their knowledge to provide services that are of value.

For instance, accountants are uniquely positioned to provide expert, cost-saving recommendations for a better customer experience.

72% of accountants think their small business clients don’t understand the idea of open banking or the advantages it could bring to their business.

2. Get the full picture

Accountancy services can enable customers to check their financial records across several banks in one location by utilising open banking.

Instead of evaluating one element of their bank account at a time, accounting services and their clients can analyse and act on the entire picture with a single view of a customer’s business transaction data.

This can enable deeper insights, giving clients a greater understanding of their firm finances and more control over their financial condition. It can help boost accounting conversations.

3. Increased efficiency and speed

Usually, transaction data imported from corporate bank accounts is unfiltered and raw, necessitating extra work to make it usable.

It might be challenging for accounting firms to combine and use this data because it frequently comes in different formats when obtained from multiple bank accounts.

But with the help of open banking platforms, firms can collect account information and offer value by cleaning it up and giving it in a standardised format.

This results in lower operational expenses and increased efficiency because it is simple to comprehend and utilise immediately.

Accounting firms can spend more time on more important, hands-on work with automated tasks.

Tax season can be less stressful and time-consuming with more client-focused Open Banking applications, as APIs gather data easily with fewer errors and lower processing costs.

This not only speeds up internal procedures but also helps accountants to improve client service efficiency and speed.

Final thoughts

What was once a disconnected, closed economy sector is now advancing at a breakneck pace.

Open banking creates new opportunities for accounting firms by facilitating access to financial data.

Accounting firms have the chance to create significant value by utilising the additional features made possible by open banking.