As a business owner, you’re in charge of keeping track of your company’s finances. If you maintain correct and up-to-date accounting records, your business will be on the right track. However, if you ignore your accounting tasks, your company will swiftly fall before it can grow.

Keeping up with accounting responsibilities is difficult for any company or organisation, but it’s incredibly overwhelming if you manage a business and handle bookkeeping independently.

Establishing a consistent bookkeeping practice can feel intimidating, especially if this is your first time. But it doesn’t have to be complex, especially if you start by incorporating good behaviours into your daily bookkeeping routine.

This blog will check how to Turn Your bookkeeping services From Zero To Hero.

Contents:

- Ways to master your bookkeeping services

- Why should you choose an outsourced bookkeeping service?

- Wrapping up

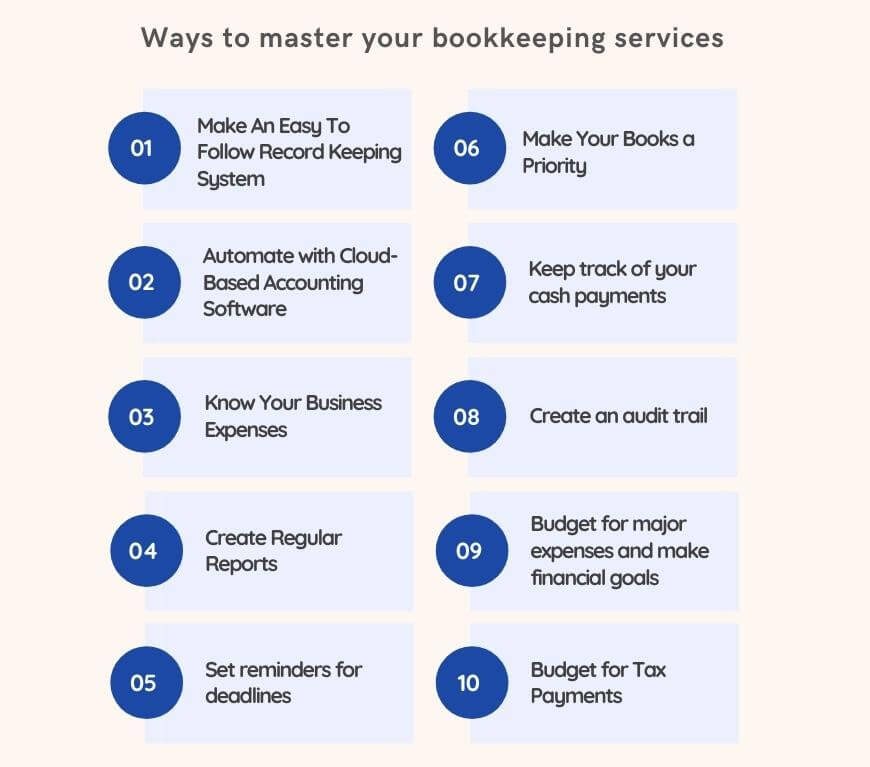

Ways to master your bookkeeping services

It is critical to improving the standard of business bookkeeping services. Despite companies’ efforts to do bookkeeping and accounting in-house, most appear dissatisfied with the results.

If you want your bookkeeping services to become professionals, you’ll need to take specific steps to improve your skills.

1. Make an easy to follow record-keeping system

Every business transaction should be recorded and organised to track cash flow, profitability and solvency. Keeping track of all business records, including receipts, invoices, and bills, will assist you in determining future business prospects and ensuring tax compliance.

While there are simple ways to digitise paper receipts, store them in a locked cabinet and organise them into a simple system if you choose to keep paper records. Having a copy of your documents is also a good idea if something goes missing.

Most cloud-based accounting software allows you to scan receipts with your phone and upload to your online bookkeeping system for storage, reconciliation and record keeping.

2. Automate with cloud-based accounting software

We live in a time where cloud-based accounting software allows you, as a business owner, to access financial data whenever and wherever.

Technology has enabled us to sort through heaps of papers, verify spreadsheets, and perform manual calculations every month. Most of the heavy work is now done for you by cloud-based software.

Accounting software can automatically deliver bills to customers on time, track your incoming and outgoing expenses, and provide cash flow reports. There are numerous software options available. The best tool for you is the one that makes your life easier, and if you’re not sure which one is best, you can always consult a bookkeeper online for guidance.

3. Know your business expenses

It’s hard to predict what expenses you’ll pay when you first start your business and which charges are tax-deductible.

For instance, costs related to the company’s operation and income generation are tax-deductible. However, buying something only for yourself is not tax deductible.

Combining your business and personal accounts doesn’t mean you may claim for everything you buy. Keep your business and personal accounts separate, review the tax laws, and know what you can claim.

Consult an accountant if you’re unsure what constitutes a deductible purchase.

4. Create regular reports

A good bookkeeping strategy isn’t just crucial for tax purposes. Tracking your incoming and outgoing cash makes it easy to perform regular financial check-ups.

Using the correct accounting software, you can ensure that all of your clients pay their invoices on time and eliminate any reporting gaps.

While monthly audits are essential, you should also review your accounting and bookkeeping records at the end of each quarter, paying particular attention to declining or increasing revenues, high expenses, or evidence of late-paying customers. A thorough analysis of your figures will assist you in forecasting future cash flow.

5. Set reminders for deadlines

If you’re a busy business owner, It’s easy to lose track of time and miss deadlines. Before you realise it, another month or year has already passed.

Set reminders to avoid missing deadlines and prepare your books for tax season. Set company tax return due dates and other reminders to your calendar to ensure you don’t miss any upcoming due dates. You can also use a digital calendar to keep track of important events and set yourself reminders.

Plan and set aside time and money for your company’s taxes. You’ll be able to pay your tax obligations on time and avoid fines for missing deadlines.

6. Make your books a priority

While keeping track of your expenses isn’t the most thrilling aspect of running a business, it does need to be a priority.

One mistake on a tax report or a poorly managed set of invoices in your bookkeeping records can throw your business off track. From the very first day, ensure you have a plan in place from the beginning for keeping your books organised and on track.

If you don’t have time to balance everything at the end of every working day, you should sort through your financial records atleast once a month.

7. Keep track of your cash payments

It’s easy to overlook this when you’re just starting, but you must keep track of your cash payments. You must deposit any money the company receives into its bank account before it can be spent – even on company products.

It’s tempting to use the money immediately to buy supplies, but this can easily mess up your bookkeeping system.

Remember to note which customer paid, so you don’t chase them up again later when recording cash payments.

If you don’t know how to manage the details of cash payments in your accounting software, bookkeeping services London can assist you in setting it up and using it properly.

8. Create an audit trail

Even if you keep your books carefully, you may still face a tax audit. You must leave a paper trail that proves everything you’ve bought and paid for your customers.

An audit trail is a collection of papers that demonstrate that the transactions recorded in your books are accurate. If you have any difficulties with tax mistakes, source papers, or missing transactions, your audit trail can assist you in retracing your activities.

9. Budget for major expenses and make financial goals

You might be well equipped on a day-to-day basis.

But what if you need to put down a deposit on a new office or buy new equipment and software to help you grow your business?

Major expense planning can help you make the most of your business credit and resources while offering you peace of mind.

Similarly, an accurate picture of your current bookkeeping will enable you to estimate realistic financial goals for your company to achieve in the next quarters or years.

10. Budget for tax payments

When your firm becomes profitable, you may decide to invest all of your funds as quickly as possible.

Spending profit on product development, marketing, and other growth activities is an excellent way to keep your business moving forward – but don’t do it too quickly.

Remember that you’ll have to pay taxes on a portion of your earnings at the end of the year. To provide sufficient money to pay your bills, you should save at least a part of your income – possibly 20%.

Use separate savings account if you’re having trouble keeping this money in your business account.

Why should you choose an outsourced bookkeeping service?

Many firms outsource a business process. Outsourcing bookkeeping services in uk can help you transform Your bookkeeping practices From Zero To Hero.

Outsourced accounting has several benefits, including the following:

1. Freedom

Work on your business while the providers take care of your accounting using secure cloud-based accounting software that lets you view your accounting data from anywhere globally.

2. Real-time information

Your accounting is handled as soon as it is received. You can collaborate with the provider to make better future decisions.

They can also work on the same data simultaneously, ensuring that it is current and up-to-date, putting actionable and present data at your fingertips.

3. Eliminate hiring costs

Hiring, maintaining, and training an accounting department is costly. On the other hand, Outsourcing the accounting function eliminates hiring and training costs.

4. Improving business continuity

When a key accounting employee leaves your organisation, your firm might face difficulties overcoming the loss.

Outsourced accounting decreases the risk of knowledge loss and enhances business continuity.

5. Security

Your accounting data is saved in the cloud on secure servers to prevent physical data loss and improve business sustainability and disaster recovery.

Wrapping up

These recommendations and the best ways to take your accounting from zero to hero are guidelines for bookkeeping so you can focus on developing your business.

If these steps don’t work, modify or eliminate and create a method that works for you. It would help if you educated yourself on practical bookkeeping fundamentals and regularly put those principles into practice. It also assists in having a solid financial management system.

Proper bookkeeping provides a reliable measure of a company’s performance. It also serves as a guide for making general strategic decisions and a benchmark for revenue and profit targets.

In short, once a firm is up and operating, it is vital to devote more time and resources to maintaining accurate records.