Artificial intelligence is highly beneficial in finance because it provides various creative services, saves time, prevents fraud, etc. It also assists in gaining a competitive advantage in the market, as clients prefer advanced and up-to-date businesses.

Several industries are using AI for various purposes, and technology is improving and becoming more innovative. In recent years, the finance industry has emerged as one of the most active adopters of artificial intelligence.

AI has changed the financial industry’s perspective, allowing better use of data insights, developing new business models to boost efficiency, and introducing new dynamics, among other things.

There are many benefits of AI to financial sectors but a few disadvantages too.

This blog post will look at the advantages and disadvantages of AI in financial services and industry.

Table of Content

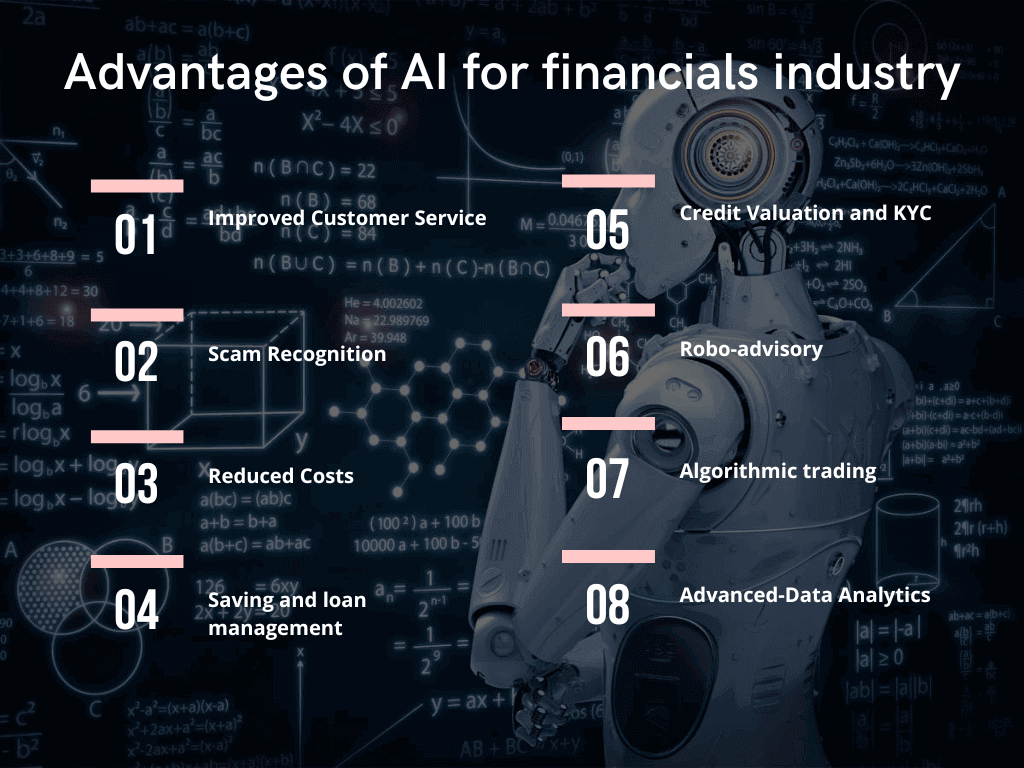

8 Advantages of AI for the Financial industry

1. Improved Customer Service

Customers willingly prefer self-service solutions that allow them to talk with a virtual assistant like a live customer agent. Virtual assistants have already been incorporated into most financial firms’ website chatbots, voice response systems, and mobile apps.

Since Artificial Intelligence views each interaction as a teachable moment, chatbots (virtual assistants) improve as they learn more about their customers. It also enables them to perform better sentiment analysis, allowing the virtual assistant to detect when people are becoming frustrated and immediately transfer them to a live representative.

Financial employees occasionally open accounts erroneously, resulting in account limits. For a client, this can be highly frustrating. AI ensures a smooth experience for your clients by accurately gathering client information and correctly setting up client accounts.

2. Scam Recognition

With the rapid increase of financial fraud, detecting and reducing scams has become difficult for the financial sector. Several financial institutions tried to identify the factors and robust solutions but couldn’t succeed. However, AI assists investigators by making it easier to detect fraud-related factors.

It enhances financial security by employing advanced fraud prevention techniques. AI works as a real-time scam solution for the financial sector while handling complex situations and tactics. AI can help fraud detection by finding abnormal transactions based on enhanced data analysis.

3. Reduced Costs

There are many expenses in finance, but one of the most important is labour cost. Compensation and benefits are the most significant single expense category for most financial institutions.

AI for accountancy can improve individual workers’ efficiency and production. For example, Decision management systems (DMS) enable humans to make intelligent decisions faster.

In addition, by employing predetermined answers to basic questions, DMS can help with faster customer onboarding. For instance, clients fill out an online application, and their answers decide the type of account available. The company will need fewer front-line employees as a result of this technology.

Human error raises the risk of losing one’s reputation and being fined by the government, which can have serious financial effects. DMS reduces this risk by ensuring that data is entered into the system reliably and consistently across all channels

4. Saving and loan management

It helps to know about the saving and expenses done by clients’ behaviour on their spending pattern and loan borrowing. AI assists in debt management by appropriately utilising the data collected for repayment.

AI assists in understanding loan applicants’ behaviour and makes it easier for banks and financial institutes to determine if a loan applicant is acceptable. For example, AI in banking and banks may use predictive analytics when considering whether or not to approve a car loan application based on past data such as credit ratings, home values, and time since the last job loss.

5. Credit Valuation and KYC

Before opening an account, financial companies must perform due diligence. Different documents are required for this process, depending on the customer’s profile.

Credit valuation can be time-consuming, especially when determining whether or not enough information about each client and their creditworthiness is available.

Artificial intelligence (AI) assists in solving this problem by automating checks against internal databases and external data sources such as national statistical agencies, central banks, public registries (i.e., property registrations), company registry agents, and social media accounts.

It lets financial institutions keep correct information about each customer, decreasing the reputational and regulatory risk associated with KYC non-compliance.

6. Robo-advisory

Given how inflation affects our savings and that keeping money in a savings account is no longer profitable, more and more individuals are interested in passive investment. And it is here that Robo-advisors come into play.

They are wealth management services in which artificial intelligence (AI) creates portfolio recommendations based on an investor’s personal goals (both short and long-term), risk preferences, and disposable income. The investor only needs to deposit money monthly (or set up an automatic transfer).

Everything else is taken care of for them, including selecting assets to invest in, purchasing them, and maybe rebalancing the portfolio after some time. This ensures the client is on the most effective path to achieving their goals.

Customers will benefit from such systems because they are simple to use and do not require any financial understanding. Naturally, pricing is a factor – Robo-advisors are less expensive than human asset managers.

7. Algorithmic trading

Probably nowhere is the phrase “time is money” as relevant as in trading, where faster analysis implies faster pattern detection, which leads to better decisions and trades. When a pattern is discovered, and the market reacts, it is too late to take action, and the opportunity has passed.

That is why algorithmic trading, which involves complicated systems making split-second decisions and independently executing transactions based on a pattern, receives so much attention and funding. Such systems can significantly outperform human traders, especially since emotions do not affect them.

Algorithmic trading systems bring together cutting-edge machine and deep learning advances from various fields. While specific components of these systems will aim to predict asset returns (to some extent), others may take a more traditional approach focused on econometrics and asset allocation theory.

Individual data scientists who try to construct their trading systems on their local computers or in the cloud are becoming more interested in algorithmic trading. With recent advances in how simple it is to begin trading and the increasing availability of different brokers’ APIs, many people are willing to try this.

8. Advanced-Data Analytics

One of the most significant advantages of AI is its capacity to automate time-consuming jobs, resulting in increased productivity. AI can swiftly consume and process large amounts of data using a machine-learning algorithm. Financial services have become more efficient due to the incredible speed, which allows for more specialised solutions for customers.

With such advantages, it is almost certain that most financial institutions would implement AI to remain competitive and provide better customer service.

4 Disadvantages of AI in the Financial Sector

AI is also expected to disrupt banks and traditional financial services massively.

The following are some of the disadvantages of AI in finance:

1. Expensive

Artificial intelligence requires a lot of money for production and maintenance because it is a highly complex machine. AI also includes advanced software that you must regularly update to keep up with the demands of a changing environment. In the event of a crucial failure, the procedure to restore the system and retrieve lost codes could take a long time and cost a lot of money.

2. Bad Calls

Though Artificial Intelligence (AI) can learn and improve, it still can’t make judgment calls. When making decisions, humans may consider specific situations and critical calls, something AI may never be able to achieve. Replacing adaptive human behaviour with AI may result in irrational behaviour within ecosystems of humans and machines.

3. Unemployment

The use of technology to replace workers could result in widespread unemployment. Furthermore, if AI is widely used, people will become increasingly dependent on machines and lose their creative ability.

If Artificial Intelligence (AI) falls into the wrong hands, it can pose a significant threat to humanity. Individuals who begin to think destructively can cause havoc with these advanced machines.

4. Clients remain suspicious of AI

People still prefer to deal with people. Excellent customer service is the most critical factor in keeping customers coming back to a bank or financial institution.

While chatbots are improving their ability to provide this kind of individualised service, achieving complete trust among financial customers will take time, leading to lost opportunities.

Final thoughts

Artificial intelligence (AI) is changing the financial industry despite potential drawbacks.

By completely implementing AI in finance, firms can reduce costs and raise revenues, giving them a competitive advantage over other financial firms that do not embrace the change.

It provides better and faster services through improved and efficient performance through AI applications in financial organisations.

AI for bookkeeping is increasingly used in various industries to boost production by ensuring accuracy and proper records. It is now drastically altering the financial services industry’s operating model, benefiting clients and the financial sector.