Traditional financial institutions have existed for a considerable amount of time and operate within a vast, complex ecosystem. This has provided a solid foundation for the growth of Fintech, a new business looking to modernise the financial sector by using technology to solve financial problems more effectively, affordably, and rapidly.

FinTech London accountants assists companies with innovative services and products like payment processing, funding sources and digital banking. It is used in various industries and companies, including retail banking, social commerce, nonprofit, healthcare, education, freelancing, retail, fundraising, entertainment platforms, and many more.

The modern financial sector is changing due to Fintech’s development to a new level of financial expertise in this digital age. In this blog, we will discover the realm of Fintech, its applications, and benefits.

Table of Content

What is Fintech

Fintech, short for “financial technology,” refers to the use of technology to improve, automate, and innovate financial services and processes. This includes mobile payments, online banking, cryptocurrencies, investment platforms, and financial management tools. Fintech aims to make financial services more efficient, accessible, and user-friendly.

What is a FinTech company?

A FinTech company modifies, enhances, or automates financial services for people or businesses.

Peer-to-peer payment systems, mobile banking, automated portfolio managers, and trading platforms are a few examples of Fintech businesses. It is also applicable to developing and trading cryptocurrencies.

These businesses improve traditional financial sectors’ speed, security, and effectiveness by integrating technology like blockchain, data science, and AI.

UK FinTech is the fastest-growing tech industry where businesses innovate in almost every aspect of finance, including loans, payments, stock trading, and credit scoring.

Why are people adopting FinTech so enthusiastically?

The obvious response is that FinTech UK streamlines previously challenging tasks. Additionally, as FinTech companies in London are now driving the industry, they must prioritise customer adoption above everything else. Their services must eliminate user experience barriers to gain user adoption.

They eliminate tasks like bringing your ID to the nearest bank office, filling out multiple forms, waiting in line for a long time, experiencing prodding credit checks, etc.

By prioritising the user experience, FinTech businesses:

- provide excellent customer service

- assist you when you have a problem

- are accountable and transparent

Application of FinTech

Traditional banks and businesses have always welcomed London Fintech with open arms as startups, and unique technology have grown.

Here is an overview of some ways Fintech has changed the financial industry.

- Banking

Mobile banking is an extensive part of the fintech sector. Consumers increasingly demand quick digital access to their bank accounts in personal finance, particularly on mobile devices. Since the emergence of “Neobanks,” digital-first banks, most large banks now provide mobile banking functionality.

Neobanks are banks without physical branch locations that provide consumers with checking, savings, payment, and loan services through entirely mobile and digital infrastructure.

- Insurance

While insurtech is an emerging industry, it still comes under the umbrella of Fintech. Since the insurance industry has been slow to adopt technology, many fintech London jobs collaborate with established insurance providers to streamline procedures and increase coverage.

The sector faces plenty of innovation, from wearables for health and mobile car insurance.

- Lending

FinTech also modernises credit by streamlining risk analysis, accelerating approval procedures, and making access easier. Applying for a loan via a mobile device is now available to many individuals worldwide.

Additionally, the technology makes the whole lending industry’s back end more visible to everyone by allowing consumers to request credit reports numerous times a year without impacting their scores.

- Robo-advising and stock trading apps

The asset management industry offers algorithm-based portfolio management and asset recommendations that have improved efficiency and lowered expenses.

One of the more well-known and significant developments in the fintech industry is the creation of stock trading apps. Investors can now purchase and sell stocks with only the touch of a finger on their mobile device using trading applications, as opposed to when they had to visit a stock exchange physically.

- Budgeting apps

Customer budgeting apps are one of the common applications of Fintech. The use of these apps has increased dramatically over time.

Consumers formerly had to manage Excel files, compile checks, and develop their budgets to track their spending.

The Fintech revolution has resulted in the improvement of financial services apps. Consumers can now efficiently and quickly keep track of their income and expenses.

- Blockchain

Blockchain is a similar technology to Fintech. It is a distributed ledger that is decentralised, secure, irreversible, and transparent and can be accessed from anywhere.

It permits the mining of cryptocurrencies and the running of its marketplace. DeFi is another blockchain-based financial model that operates independently and can’t be controlled by the government, banks, brokers or exchanges.

Even though blockchain is an entirely different technology, it is not considered a part of the fintech industry. This technology is essential for creating advanced technologies that are the fintech future.

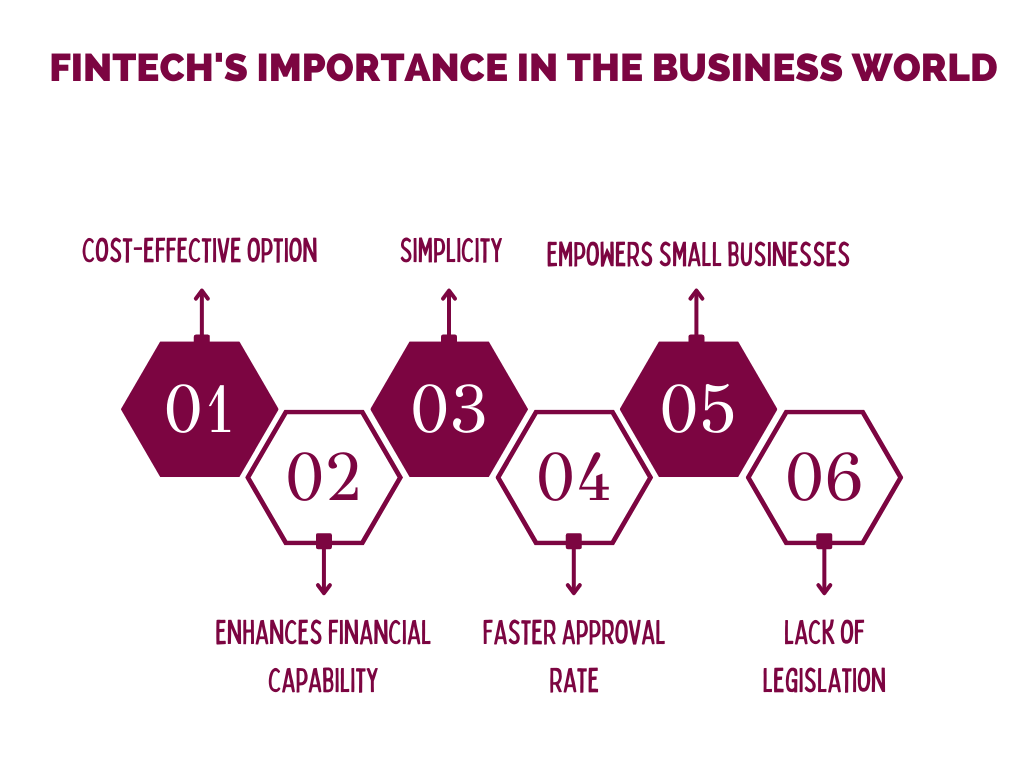

Fintech’s importance in the business world

- Cost-effective option

Compared to conventional financial institutions, fintech businesses can frequently offer the exact solution for less money. Fintech businesses can save money by using technology to automate operations rather than hiring people to perform them.

They save money by not maintaining physical branches to serve their consumers. Fintech businesses typically have low overhead expenses, allowing them to pass the savings down to you. Today, fee-free bank accounts and commission-free stock trading apps are available. This means more money in your pocket.

- Enhances financial capability

Fintech makes managing our finances easier, whether it’s for our personal accounts or investments. Innovative entrepreneurs are not just creating the financial instruments of the future but also advancing financial literacy and education.

If financial literacy is improved, more people will be able to pay off debt and grasp the benefits of setting aside money for savings and investing for the future.

- Simplicity

FinTech businesses emphasise their client’s needs and look for the best solutions to any problems they may have. It creates products that are intuitive and simple to use and are built on cutting-edge technologies, intelligent business structures, and sophisticated strategies.

Financial application development uses simple solutions to boost client satisfaction and attract additional users.

- Faster approval rate

Fintech finance innovations have enabled online or digital lenders to complete the application and approval process within a day. Customers demand services immediately; thus, with less information provided by the clients, they can get all the required services in a matter of seconds or even a few minutes.

Many customers now prefer robots to individuals thanks to artificial intelligence and automation, which are expected to power customer interactions.

- Empowers small businesses

Large corporations used to be in the lead when utilising the most recent financial and technological instruments. In the current situation, this is no longer the case.

Now, even a solopreneur may utilise some of the large corporations’ technologies, whether for processing payments or managing your accounts. Small businesses can increase the scope and scale of their operations while expanding their service offerings thanks to innovative finance technologies.

- Lack of legislation

Since there aren’t many strict laws and regulations for fintech innovators from entering the market, they frequently utilise an asset-light company strategy.

The asset-light model is a business strategy in which you leverage the resources and infrastructure already in place to create an ecosystem for the services you provide rather than investing a significant amount of money in capital expenditures.

This approach is also quite useful when launching a new project quickly and cost-efficiently. However, the current set of regulations on business registration established by regulators has made startups pay attention and put efforts into getting a licence.

Stay updated with the current FinTech news to know about the changing legal regulations.

Final thoughts

As financial organisations adapt to a tech-driven economy, individual finance experts must also prepare themselves with the tech skills required to succeed in the same fast-moving digital environment.

FinTech jobs in London are emerging and will play a significant role in the world economy, enterprise landscape and the development of modern society. The field is extensive, expanding quickly, and is here to stay. It has created many opportunities in the corporate world. The innovations have allowed firms to introduce new and cost-effective products and services.

London fintech week is a place where traditional financial organisations come together with emerging Fintech in one of the oldest financial centres in the world. It is also essential for companies to adopt and implement such technologies to keep up with the competition. This will lead the business to grow and develop.

Leave a Reply