Starting a business in the e-commerce industry can be promising as more consumers purchase online. However, with this, your focus on bookkeeping services must increase, as it will give a real picture of businesses’ financial health.

From calculating taxes and managing online inventories to considering shipping charges and other financial activities, e-commerce bookkeeping is complicated but essential.

This blog post covers the importance of e-commerce bookkeeping and how you can implement it in your business.

Table of Content

What is Ecommerce bookkeeping?

E-commerce bookkeeping refers to the record-keeping process of e-commerce businesses. It keeps track of the money inflows and outflows from business and records these transactions in accounting books. For example, if a customer purchases your products on your website or subscribes to your platform, such transactions are recorded in books. These financial records further help in creating accounting statements for your business.

Bookkeeping practices are not similar to regular accounting practices performed digitally. It is complicated as you need to track shipping charges, sales tax compliance, online inventory management, and other day-to-day activities.

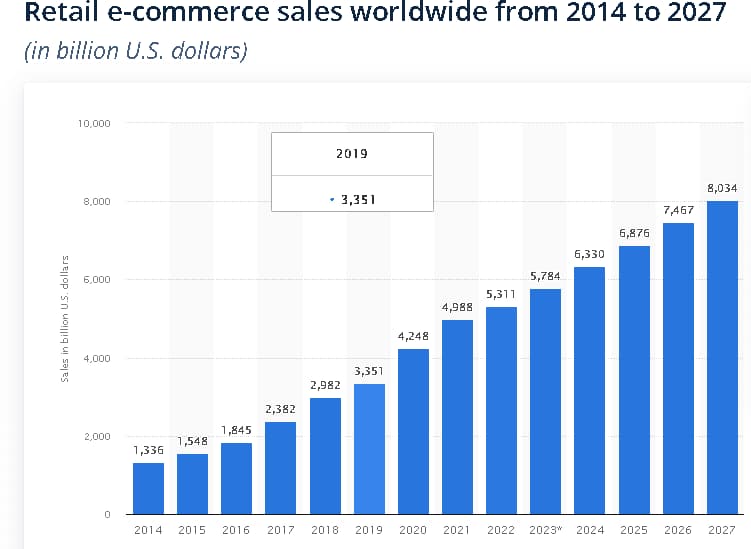

This graph illustrates how the E-commerce business is growing rapidly globally. According to reports, the UK ranks among the top three largest e-commerce markets globally, with an expected revenue growth of 12.6% by 2025.

Selecting a niche market or launching innovative product lines is insufficient to survive this rising competition. You need a strong bookkeeping practice such that your business abides by all the tax laws and regulations of the country and you have a good eye on your financial health.

E-commerce bookkeeping best practices

- Integrate your store with accounting software

You must integrate your e-commerce platform and bookkeeping software to assist with all necessary practices. This includes calculating sales tax, filing tax returns, tracking financial health, recording transactions, etc. These tools can automate your day-to-day activities and save you money in the long run.

- Record ecommerce sales

Recording e-commerce sales is essential as it tells you about customer preferences, emerging trends, and potential inventory requirements. You must create and maintain proper sales invoices, including customer details, product descriptions, transaction dates, etc., and payment records, including payment methods, date and transaction fees.

- Understand your tax obligations

Every business has different tax obligations, and you can enjoy tax-free allowances in the UK. Therefore, you must understand your tax obligations with the help of an expert.

If you register for VAT or sales tax, you must collect them efficiently from customers and mention them on your returns. Similarly, you must stay compliant with all other rules and regulations.

- Reconciliation of accounts regularly

Whatever e-commerce platform you use, reconciliation of accounts is a must. First, you must download all your sales logs, review them, and reconcile accounts regularly. This ensures there is no gap in the financial record keeping that can cause problems in the future.

- Manage product returns and chargebacks

E-commerce businesses often receive return requests and proceed with chargebacks. You need to keep track of these as they greatly impact your financial statements.

- Keep track of your expenses

Your platform may keep track of the expenses you make on the platform. But there can be additional expenses like staff payments, manufacturing costs, supplier payments, marketing and advertising charges, etc. As a bookkeeper, you need to keep these records updated on books.

- Handle sales tax

Charging sales tax on online sales is new in the UK. Any profits made above the tax-free threshold throughout a calendar year are taxable as per the new regulations. To handle sales tax, you must register for it, understand your nexus, determine the taxable products, collect sales tax, and file a return.

- Manage online inventories

Inventory management is essential for online sellers, as inventories are considered assets that hold value. It allows you to understand how much stock you have and how much is needed, as well as emerging sales trends and adjusting pricing strategies. You need to keep track of them monthly or quarterly; bookkeeping software can help you manage them efficiently.

- Develop financial statements

Every e-commerce business must have financial statements, including (balance sheet, cash flow and income statements). It illustrates a business’s financial health and keeps track of revenue, expenses, profits and debts. These statements are a great resource for attracting potential investors and applying for loans.

This image illustrates the common mistakes that e-commerce businesses make and what are the best bookkeeping habits you can adopt.

How to do bookkeeping for an ecommerce business?

To fulfil your bookkeeping needs for e-commerce business, you can purchase the latest tools and software. These can automate your processes, eliminate the risk of manual errors, and ensure accuracy.

Additionally, you can hire a bookkeeper for your business. As an e-commerce platform, outsourcing bookkeeping to a remote professional can be the ideal choice. They don’t meet you physically but assist you with all your requirements on time. However, this requires proper research and the hiring of experts with good market reputations.

The table below represents the basic difference between e-commerce bookkeeping and accounting. Though both these terms are used interchangeably, there are differences in the scope of work.

| E-commerce bookkeeping | E-commerce accounting |

| Records financial data and transactions of e-commerce businesses. | Analyses the data recorded in books and interprets them. |

| Ensures all records are reconciled and accurate. | Creates reports based on the records created by a bookkeeper. |

| Creates the stage for accountants to perform their tasks. | Depends on bookkeepers for financial data. |

| This can be complicated, but it focuses only on recording transactions and reconciliation of accounts. | This is much more complicated than bookkeeping as it focuses on creating financial models, forecasts, budgets, audits, tax planning and reporting, risk analysis, and more. |

Final thoughts!

E-commerce bookkeeping is essential for your business as it ensures you are aware of your financial health and creates statements that can assist you with business growth, raising funds, forecasting the future, etc.

However, when your business starts expanding, the financial scenario becomes complicated. It is when you can hire a professional to handle your bookkeeping and accounting needs. This will save you money and time, ensure you comply with the changing regulations, and grow your business efficiently.