Is your startup in its growing phase?

There must be a lot of responsibility, from focusing on product launches to tackling sales and inventories, managing sales and customer support, and more. Adding a CFO to your finance team can be the right option now. These top-tier professionals can analyse your financial data and take over all your finance-related responsibilities, leaving you to focus on business operations.

There are multiple other times when you need to hire these professionals in your startup. This article shares when and how you can hire CFO services in your business.

Table of Content

What is a CFO?

A Chief Financial Officer (CFO) is a top-level financial expert responsible for a company’s financial planning and analysis. These professionals mainly focus on monitoring cash flow, helping startups with budgets, preparing financial forecasts, and organising fundraising opportunities.

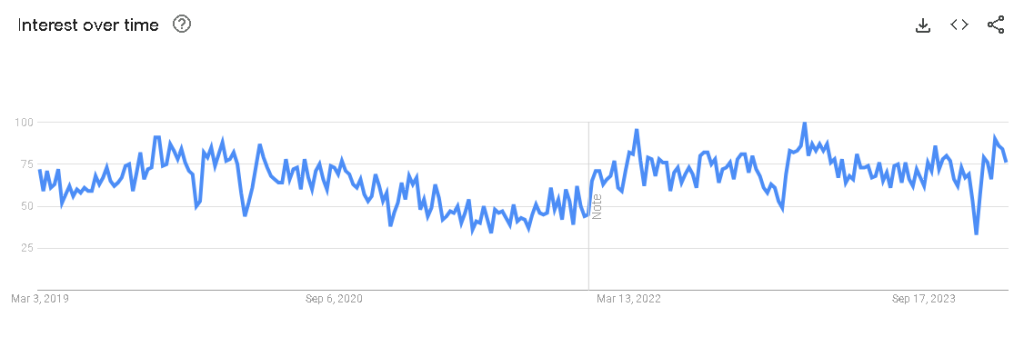

The graph below shows the demand for startups in the UK during the past 5 years.

To survive the rising competition among startups in the UK, you need to be financially stable. It is where hiring a CFO can be a great solution. These professionals have a clear understanding of your business and industry. They can use their knowledge and expertise in financial reporting, creating strategic plans, working on projections, analysing budgets, and assisting in fundraising.

Types of CFO

There are mainly four main types of CFOs in the UK. You can hire them as per your startup needs and financial constraints.

- Full-time CFO

These in-house employees work according to fixed office hours and manage your daily financial activities.

- Fractional CFO

They are also known as part-time CFO, who work fewer hours than full-time CFO and work for multiple businesses at a time.

- Interim CFO

These CFOs work within a company for a limited period, providing full-time or part-time services as per the company’s requirements.

- Virtual CFO

Such a CFO usually work with an agency or is a freelancer who offers you services remotely. They are a cross between fractional and interim CFOs, engage with a company for a particular period, and work as per the company’s requirements.

Is hiring a startup CFO mandatory?

Hiring a startup CFO isn’t mandatory, but having them on your back can be helpful. You can hire a full-time or a virtual CFO in the early stages of your startup. However, make sure you consider their services if they are needed for your business right now and your financial health.

The table below shows the basic difference between an in-house CFO and a Virtual CFO.

| In-house CFO | Virtual CFO |

| Pay a fixed salary throughout the year, along with employee benefits | Pay an hourly rate or a fixed amount for their service duration |

| Get the quickest solutions to your problems | Wait till the CFO is free to answer your questions |

| More accountability to shareholders, employees, and board members | Require additional monitoring of their working |

| Better understanding of your business and industry as they are highly connected to your startup | Lack of understanding of your startup even though they are experienced working in your industry |

| Higher risk of employee fraud | Outsourcing agencies ensures unbiased support and fewer chances of fraud |

| Limited flexibility in choosing services | Higher flexibility in choosing services as per need |

When is the time to hire a CFO for your startup?

There is no specific time for hiring a CFO in your startup, but some situations mandate hiring these professionals.

- Early-stage startup looking for financial stability

When you have a solid business plan in place, you can start looking for a CFO. These professionals have experience in managing the financial health of startups. They can analyse your financial statements and budgets, forecast your business future, and create accurate financial reports.

It ensures you have a smooth cash flow in business and stay prepared for any market changes.

- Startups raising funds

If you are raising funds for your startup, hiring a CFO can be helpful. Most investors prefer speaking to a financial expert other than the founders to understand your business prospects and financial forecasts. A CFO has experience in financial presentations, assisting you in pitching for investments and acquiring funds.

- Your startup finance gets complicated

It is not just money ins and outs; a startup must face different financial scenarios. From keeping track of your bank statement reconciliations to understanding income streams for taxes, business finances can seem to be complicated.

Additionally, when your startup starts growing, finances get complicated, and you need expert backing to survive such situations. CFOs have the experience to keep track of your finances and advise you on certain situations that save you money in the long run.

- During significant business growth

If your startup gets more revenue, the next concern is how to use the money. Should you buy new inventories or invest your money into stocks? A CFO can guide you through such situations, analyse financial data, forecast business futures, and make better decisions.

- Seamless regulatory compliance

When you are a newcomer in the industry, you might not know all the rules and regulations in the country. This often leads to huge penalties or closing up hundreds of startups in the UK every year. If you aren’t aware of the law, hiring a CFO with knowledge of legal and regulatory compliance is beneficial for your startup.

How to hire a CFO for a startup?

There are multiple ways of hiring a CFO in your startup. You can bring in an in-house from within your network or through reference. Startups also put up hiring alerts on different job boards to connect with experienced CFOs.

However, if you have financial concerns and require a professional to manage a few finance-related tasks, outsourcing CFO services can be helpful.

But before looking out for these professionals, make sure you have decided on the roles and responsibilities you expect them to fulfil. Then, check their qualifications and experience thoroughly to understand if they can work with a startup and have sufficient knowledge of your industry.

Final thoughts!

Hiring a CFO in a startup is a thoughtful decision, as these financial experts can improve your financial health in the long run. You can hire them as early as possible or when finances get complex and you need to raise funds. However, research them thoroughly to understand their experience and knowledge of your business and industry.