Accounting apps help financial experts track and report a company’s financial operations. Their requirements differ from company to company; while some people merely need standard, off-the-shelf accounting tools, others need complex, customised tools.

Instead of using spreadsheets or a paper-based system, even the smallest firm will profit from using accounting apps. It simplifies managing your business finances and speeds up preparing and submitting your tax and VAT returns. But how do you pick the best app for your business when so many are available in the market?

Based on features, functionality, and other considerations, we’ve compiled a list of the top accounting app for small businesses.

Table of Content

Best accounting and bookkeeping Apps for small business

1. QuickBooks

When someone hears “small company accounting and bookkeeping apps,” Quickbooks may be the first tool that comes to their mind. The tool distinguishes itself with features like receipt capture and round-the-clock chat support, in addition to its excellent package.

Businesses can create, transmit, and track paid and unpaid invoices using the QuickBooks accounting app. You can add colours, logos, and custom fields to invoices and sales receipts.

The cash flow dashboard provides personalised financial information about your business to help you make wise decisions. You can also send clients direct emails with payment receipts for payment confirmation.

2. FreshBooks

FreshBooks is a simple tool that streamlines bookkeeping and accounting for small businesses. FreshBooks’ app, according to its website, can assist users in reducing the amount of time they spend filing their taxes by up to 46 hours annually.

You may manage your finances and accounting from a single dashboard integrated with various business applications. The app lets you always stay on top of your business and provides regular safe backups.

To help you avoid annoying excuses from customers, it even has a function that lets you view the precise location where a customer opened your invoice. It’s worth considering, with reasonably priced solutions to suit businesses of almost any size.

3. Wave

For small businesses and independent freelancers, Wave is a helpful accounting app. It puts a lot of focus on simplicity and synchronicity, making it easy for you to link your bank accounts, keep track of your expenses, and balance your books.

If you purchase Wave’s other products, it also aligns with their additional resources, giving you a complete solution.

It offers several professional invoice templates so that you can send personalised invoices. Receipt capturing is just as simple as snapping a photo with your phone and also functions offline. With updated plans, you can integrate payroll procedures and accept online payments.

4. Xero

One of Xero’s standout features is its mobile interface, making it an excellent choice for business people who work on the go. Using your tablet or phone, you can use the app to send personalised invoices, keep track of inventory, and make purchase orders to attach bills.

Transparency into cash flow, bank account balance, profit and loss, etc., is provided via the dashboard. You can check all your business expenditures at once to make sound decisions.

5. Zoho Books

It is a fantastic tool for managing your small business’s finances and cash flow. Using the app to automate procedures, you can collaborate with people from other departments. It has the best time tracking, banking, inventory management, and financial reporting capabilities, all supported by an industry-leading UX.

The easy-to-use interface of Zoho is one of its main selling points. It has a simple-to-read dashboard that practically every employee in your company can understand. It also provides advantages, including the best client service and the ability to collect payments online. In general, Zoho is among the best applications for casual users.

6. Sage

The Sage accounting app enables users to track spending, manage inventory, provide estimates and quotes, etc. You can provide supporting files, such as images or other files, along with your invoices. You can monitor your unpaid invoices and send notifications to encourage quicker payments.

Sage offers users more than just a user-friendly app; it also provides them with the resources they need to use that app to manage their businesses successfully. This is important because many small-business owners lack substantial bookkeeping backgrounds.

7. Bookkeeper

The Bookkeeper app is popular among accounting apps, with half a million users.

If you need a straightforward accounting and invoicing tool that is user-friendly and has lots of functionality, Book Keeper Accounting + Invoice is a fantastic choice.

One of the app’s most impressive features is inventory management. It manages inventory, works with various warehouses, and generates barcodes that can be scanned using the camera on your phone. The tool syncs your data across all of your work devices using Dropbox.

8. Expensify

By using the Expensify app, you can capture receipts on your phone. Expensify’s SmartScan will specify the pass’s payee, amount, and other important information. After that, you can send the receipts to other platforms to be synchronised and, if required, reimbursed.

Expensify also has a great travel concierge and trip planner, as travel and expenditure reporting are closely related. Send Expensify your itinerary, and it will track your journey. You’ll also receive updates on your flights, and the concierge will let you know if your travel expenses are going over your budget.

How to select the best accounting app for your small business?

Several application options are excellent, but how do you know which one is best for your company? When looking for an accounting or bookkeeping app, remember the following points.

- Identify your needs

Are receipt tracking and sales tax more significant, or do you require a platform that lets you track inventory? List your accounting requirements and rank them in order of importance, starting with the least critical. Before researching solutions, agree upon several needs your chosen app should meet.

- Be honest about your budget

Decide your budget to spend on accounting or bookkeeping applications before starting the research part of the process. Avoid wasting too much time examining an application that isn’t feasible once you realise how much money you have budgeted.

Budgets often have some wiggle room, but make it a practice that you’ll walk away if an app is more than 25% over your decided budget.

- Research for features that meet your needs

It’s obvious to get starry-eyed about accounting app features. But if you consider apps that specialise in offering accounting services for international teams — and you only conduct business in the Uk— you may find yourself paying for a lot you don’t require.

Return to your list of prioritised requirements and consider only the applications that meet most of those needs.

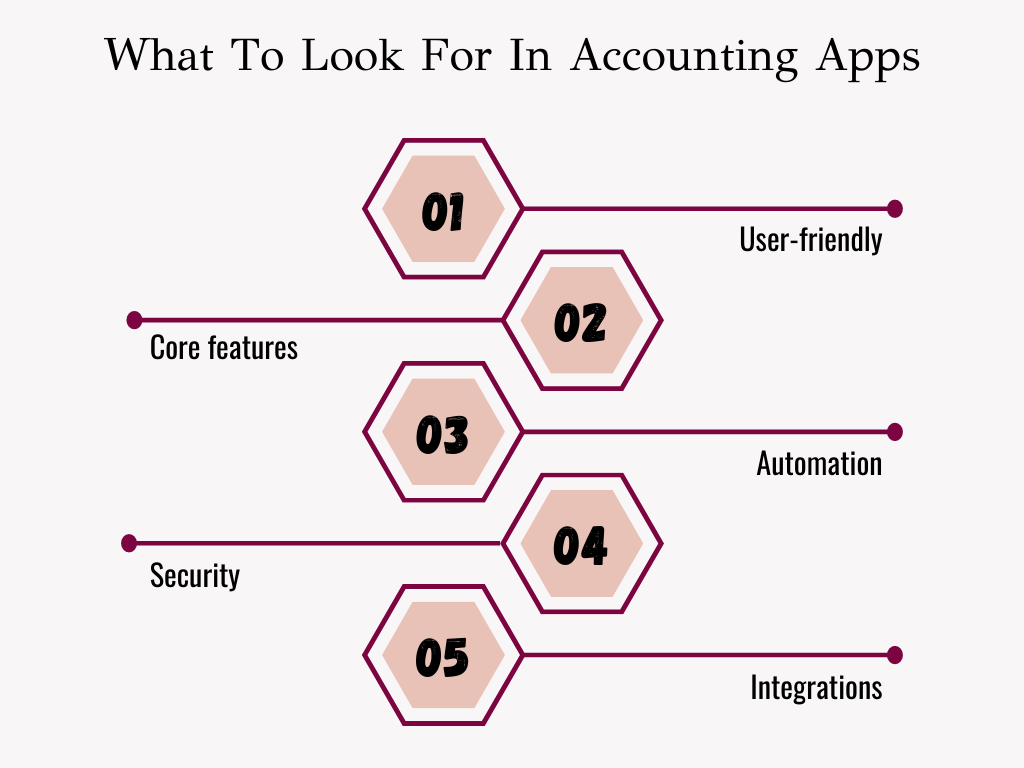

What to look for in small business accounting and bookkeeping apps

A small business accounting application can make it simpler to complete all activities on the go if you evaluate the following before purchase:

User-friendly

Not everyone can work with numbers, and accounting procedures are not simple. Your chosen app should have features that make working with your financial data easier.

Making the financial work easier for you or the staff members who handle your accounts will start with a clean, uncluttered user interface that makes it simple to detect crucial accounting details and built-in capabilities to perform accounting calculations automatically. Additionally, your app should be simple and speed up task accomplishment.

Core features

All fundamental accounting functions, including reconciliation, invoicing, monitoring expenses and profits, etc., must be included in the accounting app for small businesses. This will let you work on the go even when you are not in the workplace.

Also, the application you choose should provide a free trial. The free trial lets you know how the app works and helps ensure the system meets all your needs before purchasing.

Automation

You are transitioning from a spreadsheet- or paper-based accounting to app-based accounting primarily to reduce errors and save time. As a result, most repetitive processes, such as recording information from receipts or tracking transactions, must be automated in the app.

Security

Data security should be your primary priority when choosing accounting apps. Learn about the company’s application data storage practices. Many reputable cloud hosting providers use their servers to host the application. Ask the organisation about the security precautions they take to protect your data before using their application.

The app must continue to comply with all local laws and regulations to simplify tax filing for the business owner. Since financial information is essential, the app must have security features like unauthorised access protection.

Integrations

Integrations allow your accounting apps to be more flexible. They let you work with different tools without leaving your accounting applications. Changes in an integrated tool are automatically updated in your accounting application, eliminating the need for repeated data entry.

The accounting app you select should be capable of integrating with third-party services, including project management tools, CRMs, and inventory management systems.

Final thoughts

A good accounting application benefits a small business by saving time and the resources needed for accounting tasks. Consider these accounting apps for your small business. The accounting app will also help you manage your firm’s finances and balance the books, regardless of your level of accounting expertise.

You can also consult an accountant to help you select the best accounting app for your firm. Every industry is different, and the accountant can provide you with an educated opinion about which one is the best option for your particular enterprise. They can also assist you in setting up the application you choose.

Leave a Reply